Your Shortcut to Accurate, Stress-Free KVK Filing

Complete iXBRL preparation, validation, and review services that meet KVK standards

What Is It About?

As of January 1, 2026, all companies registered in the Netherlands are required to submit their annual accounts to the Kamer van Koophandel (Chamber of Commerce) or KVK in a digital, structured format. This move aligns with European Union’s efforts to enhance transparency and consistency in financial reporting.

This mandate requires companies to submit their annual accounts in a structured electronic format that ensures consistency, accuracy, and improved accessibility to reliable business information for regulators, stakeholders and the public. As part of this transition, organisations must adopt compliant XBRL/iXBRL reporting practices to meet KVK standards and avoid filing delays or rejections.

What We Deliver

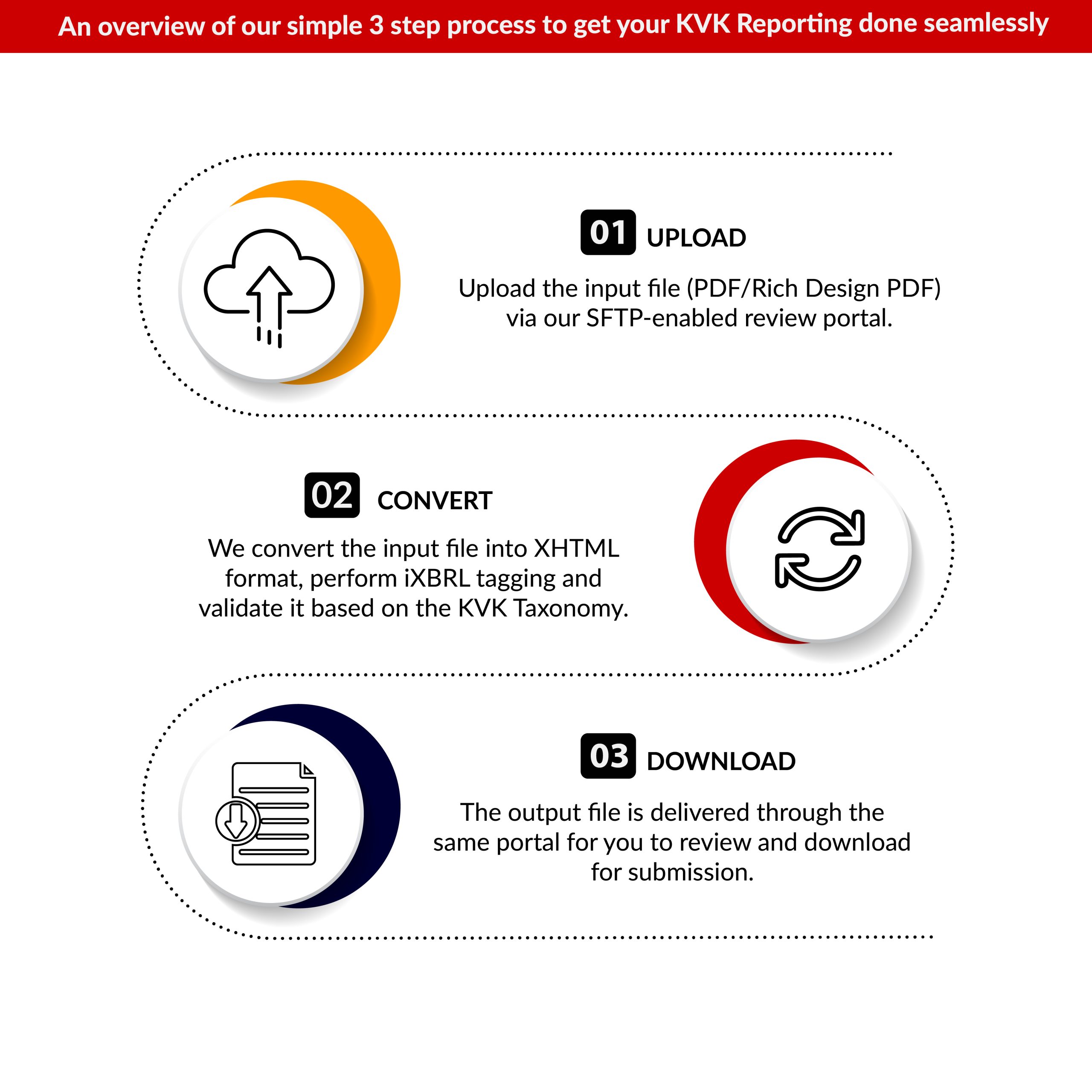

At DataTracks, we deliver KVK reporting solutions that ensure compliant, accurate, and audit-ready filings for companies in the Netherlands. Our XBRL/iXBRL outputs are reliable and meet all KVK requirements.

What We Offer:

- Preparation and conversion of financial statements into XBRL/iXBRL formats compliant with KVK specifications

- Validation of all tags to ensure accuracy and error-free submissions

- Expert review by in-house XBRL specialists

- Support for various Dutch structure, including micro, small, and medium-sized entities

- Guidance through the end-to-end filing process

Why Choose DataTracks for KVK Reporting

- 24/7 customer support: During the filing season, our dedicated team is available to respond to questions, provide explanations and assist you at every turn.

- Guaranteed industry-best pricing: Competitive pricing for high-quality compliance outputs without sacrificing standards.

- Fastest turnaround in the industry: Quick, accurate and reliable delivery for submissions that have a tight deadline.

- More than 20 years of experience with international regulatory reporting.

- A proven track record of successfully completing multiple European mandates.

- Robust internal review procedures that ensure accuracy and consistency.

Featured Content

February 11, 2026

June 18, 2025

What is ESEF Reporting?

ESEF stands for European Single Electronic Format. It is a new reporting format for public companies in the European Union that requires them to publish their annual financial reports in a single, electronic format. ESEF is designed to improve the transparency and comparability of financial reporting across the EU.

Which companies need to comply with the ESEF tagging mandate?

What are the requirements for preparing an ESEF iXBRL report?

ESEF iXBRL reports must be prepared in XHTML format, with IFRS consolidated financial statements tagged using XBRL. The XBRL tags must be embedded in the XHTML document using Inline XBRL technology.

Who is affected by the ESEF reporting requirement?

The ESEF Reporting Requirements affect all issuers whose securities are admitted to trading on regulated markets within the European Union (EU), as well as all issuers who are required to prepare consolidated financial statements in accordance with International Financial Reporting Standards (IFRS), unless they are small and micro enterprises (SMEs) and their securities are not admitted to trading on a regulated market.

What does the ESEF regulation mean for auditors and supervisory boards?

The ESEF regulation focuses on publishing annual financial reports, with compliance extending beyond converting audited data into electronic format. The ESEF-RefE emphasizes third-party verification of accuracy. Although the EU Commission handles the audit, auditors and supervisory boards play a crucial role in confirming tag accuracy. At DataTracks, we assist auditors for precise ESEF reporting, enhancing overall financial disclosure quality.