All You Need to Know About ESEF Block Tagging

Key Takeaways for ESEF Tagging

- Mandatory Compliance: All issuers listed on EU regulated markets are required to prepare their annual financial reports in the European Single Electronic Format (ESEF), which includes XBRL tagging.

- iXBRL Format: Reports must be prepared in Inline XBRL (iXBRL) format, combining human-readable HTML with machine-readable XBRL tags, facilitating both investor understanding and automated data processing.

- Tagging Requirements: Financial statements, including primary financial statements (PFS) and notes, must be tagged with XBRL taxonomy elements, ensuring standardized and comparable financial data.

- Block Tagging and Detailed Tagging: Initial requirements focus on block tagging of the primary financial statements, with detailed tagging of notes becoming mandatory in subsequent years.

- Taxonomy Updates: Issuers must stay updated with the latest ESEF taxonomy, which is revised annually to incorporate changes and updates in IFRS standards.

- Software and Tools: Utilizing robust ESEF reporting software and tools can streamline the tagging process, ensuring accuracy and compliance while reducing manual efforts.

- Review and Assurance: Companies should implement thorough review processes and consider obtaining external assurance to ensure the accuracy and completeness of ESEF tagging.

- Training and Expertise: Investing in training for internal teams or engaging external experts can help companies effectively manage the complexities of ESEF tagging and compliance.

- Consistency with Financial Reporting: ESEF tagging should be consistent with other financial reporting requirements, ensuring that the same financial data is accurately represented across different reporting formats.

- Implementation Timeline: Companies need to be aware of the phased implementation timeline and ensure timely preparation and submission of their ESEF-compliant reports.

ESEF text block tagging is a notable inclusion in the filing requirements for the upcoming 2022 reporting cycle in the EU. In addition to phase 1, where the issuers were only required to tag the primary financial statements, phase 2 of the ESMA ESEF mandate also requires tagging all notes to financial statements using block tagging. Here’s everything you need to know about ESEF block tagging for the phase 2 mandate.

What is Block Tagging?

ESMA requires all issuers to tag each note to financial statements with XBRL tags as per the ESEF taxonomy. The Regulatory Technical Standards (RTS) on ESEF include several elements defined with the “TextBlockItemType.” These elements tag larger pieces of information included in the IFRS Consolidated Financial Statements. Each note to the financial statements is treated as a single fact and tagged with an element from the taxonomy.

For disclosures corresponding to more than one element with different granularity, issuers should multi-tag the information to the extent that corresponds with the information’s underlying accounting meaning.

When Did ESEF Phase 2 Block Tagging Become Mandatory?

The ESEF block tagging requirement mandates that companies electronically tag the entirety of their notes to the financial statements using specific XBRL tags aligned with the ESEF taxonomy. This is in contrast to tagging individual data points within the notes.

The mandate is effective for financial years starting on or after 1st January, 2022. Mandating text block tagging for year 2 of ESEF reporting helped facilitate the smooth implementation of financial reporting in a machine-readable format and allowed issuers time to adapt to the iXBRL technology in phases.

Which Companies are Affected?

ESEF text block tagging is only required for EU-listed companies that prepare IFRS consolidated financial statements. Companies subject to ESEF requirements must use the mandatory elements listed in Annex II, Table 2 of the ESEF RTS to tag their consolidated IFRS financial statements.

Key Points:

- Focus: Block tagging targets the notes section of the financial statements.

- Method: Entire sections of text within the notes are assigned a single relevant XBRL tag.

- Applicability: This applies to companies that already used XBRL tagging for the primary financial statements.

Tagging Elements of Annex II

The RTS on ESEF requires issuers to mark up disclosures corresponding to the elements in Table 1 and Table 2 of Annex II only when these disclosures are present in their financial statements. However, the disclosures need not be tagged if they are not in the issuer’s financial statements. Furthermore, issuers are not required to include those disclosures in their financial statements or add an indication that they are not present for the sole purpose of tagging such information using elements listed in Annexe II’s tables.

The Granularity of Block Tagging

In certain cases, block tagging of notes includes tables with different rows and columns. ESMA recommends applying the corresponding elements to the lowest level of granularity, i.e., the entire table, instead of applying them to selected rows and columns. If the disclosure includes certain numerical values in tabular format, then you are not required to tag such data with ‘Monetary Concept’ XBRL tags.

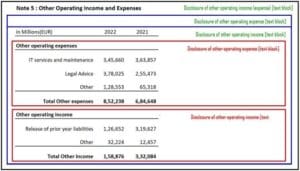

Example: The granularity to block tag a table in the notes to the consolidated IFRS financial statements of a company

Other Considerations for Block Tagging

There is no obligation to create an extension element to block tag notes and accounting policies that do not correspond to any element in Annex II. However, ESMA encourages creating an extension element to block tags, as this information can be useful to the end users. Furthermore, there is no obligation to anchor such extensions in the notes to the financial statements. For further details, you can access the latest version of the ESMA ESEF Reporting Manual here.

A Deep Dive into ESEF Tagging Regulation Essentials

The ESEF mandate, introduced by ESMA, revolutionizes how EU-regulated market issuers prepare their annual financial reports. This mandate necessitates the adoption of the ESEF format, marking a significant leap towards making annual financial reports machine-readable and vastly more accessible. This transition ushers European capital markets into a new era of digital information exchange.

Elevating Financial Reporting Standards with ESEF

At its core, the ESEF format aims to significantly enhance the accessibility, analysis, and comparability of annual financial reports. By leveraging the capabilities of iXBRL technology, ESEF simplifies the process of analyzing and comparing reports, providing a standardized and universally understood framework for financial data.

Automating Analysis through XBRL

The adoption of XBRL within the ESEF framework facilitates the automated processing of financial reports, eliminating the need for manual interpretation. This automation allows for the effortless comparison of countless reports, streamlining the analysis process.

Key ESEF Tagging Compliance Requisites

Complying with ESEF’s intricate requirements is a complex task, encompassing the selection of appropriate XBRL tagging software and ensuring the precision and consistency of financial reporting. Keeping abreast of the myriad rules, manuals, and technical specifications is a formidable challenge.

Essential ESEF Tagging Compliance Requirements

- xHTML Annual Reports: Annual financial reports must be prepared in xHTML format, ensuring they are human-readable and accessible via standard web browsers.

- iXBRL Integration: Consolidated financial statements should incorporate XBRL tags within the xHTML file, merging XBRL’s data structuring benefits with the visual appeal of AFRs.

- Detailed Financial Statement Markup: Issuers are tasked with meticulously marking up their primary financial statements, ensuring all figures are correctly linked to the appropriate ESEF taxonomy element.

- Consolidated Statements Tagging: AFRs containing consolidated statements in line with IFRS must be tagged with iXBRL, making the data machine-readable.

- Block Tagging and Multi-Tagging: Accounting policies and financial statement notes must be block tagged using iXBRL. In instances of overlapping disclosures, multi-tagging is crucial for accurate data representation.

Advanced Compliance Tips on ESEF Tagging

- Ensure text-block tagged facts maintain clarity and legibility, mirroring the original report’s format.

- Adhere strictly to ESMA-endorsed taxonomy rules, avoiding arbitrary taxonomy elements.

- For taxonomy extensions, anchoring to the core taxonomy element is advised, though not mandatory for notes to the financial statements.

- Remove executable code from ESEF files to mitigate security risks.

- Be mindful of local regulatory file size limits, despite ESMA not specifying a maximum.

- Submit ESEF reports as ZIP files containing both the xHTML file and a taxonomy package.

Challenges of ESEF Block Tagging

Subjectivity

Deciding on the appropriate content for each text block tag requires collaboration between issuers, auditors, and service providers. Considerable discussion might be necessary to reach agreement, especially if there’s a lack of in-depth knowledge about both the tags and the company’s financial statements.

Human Validation

Unlike numerical data which software can readily validate, assessing the accuracy of text block content heavily relies on human expertise. This process typically involves preparers and then auditors, ensuring the tagged information accurately reflects the intended meaning.

Limited Software Support

Software claiming to automate validation for block tagging content might be misleading. Human judgment plays a crucial role in verifying the appropriateness of the tagged content within the financial notes.

The Benefits of an Experienced Partner in ESEF Block Tagging

While ESEF iXBRL block tagging offers advantages in financial reporting, it can be a complex and time-consuming process. Here’s why partnering with an experienced service provider can be a significant shortcut:

Reduced Learning Curve

- Steep learning curve: Mastering the intricacies of over 250 ESEF text block tags is a daunting task. Partnering with an experienced service provider eliminates the need for in-house experts, saving valuable time and resources.

- Precedent setting: Experienced partners can guide your team in establishing precedents for tag application, ensuring consistent and accurate tagging throughout the process.

Enhanced Efficiency

- Faster implementation: A seasoned partner arrives with in-depth knowledge of the tags and their application, allowing for quicker and smoother block tagging implementation.

- Streamlined communication: The inherent subjectivity of block tagging often leads to extensive discussions with auditors. Experienced partners facilitate communication by leveraging insights from similar projects, leading to more productive discussions.

Improved Quality Assurance

- Human oversight remains key: While software exists, human judgment is critical for validating the accuracy of tagged content within the financial notes. Experienced partners can provide a reliable layer of human expertise for quality control.

- Maintaining XBRL quality: Beyond speed, maintaining high XBRL quality is crucial. Partnering with a service provider with a strong track record protects data integrity throughout the process.

DataTracks: Your ESEF Tagging & Reporting Software Partner

DataTracks offers a comprehensive ESEF reporting software solution that simplifies block tagging, streamlines the filing process, and ensures regulatory compliance. In addition to its software, DataTracks provides expert guidance and support throughout the ESEF reporting journey.

Let DataTracks help you navigate the complexities of ESEF block tagging and ensure high-quality financial reporting.

What are the Next Steps?

Given the new requirement of ESEF block tagging, marking up the financial statements with text block tags will demand detailed knowledge and experience. If you do not have sufficient internal resources to prepare an error-free ESEF report compliant with the phase 2 requirement of text block tagging, you can outsource your ESEF requirements to a trusted service provider.

DataTracks has an experience of more than 18 years of preparing error-free, compliance reports globally. While block tagging may be new to your company, it is not for DataTracks , as our experts have prior experience in the field for other regulators. So without further delay, get in touch with a DataTracks professional @ +31202253702 or email enquiry@datatracks.eu to know more about how we can assist you in complying with the new ESEF block tagging requirement.

ESEF Reporting Mandate Timeline: Key Milestones

Here’s a tabular summary of the key milestones and developments in the implementation of ESMA’s Electronic Single Electronic Format (ESEF) mandate:

| Milestone | Description | Date |

|---|---|---|

| Initial Assignment | ESMA assigned to develop Regulatory Technical Standards (RTS) for a digital reporting format as per the EU Transparency Directive. | N/A |

| Development Phase | Tasked with developing the European Single Electronic Format (ESEF) for annual financial reporting. | 2013 |

| Final Draft Release | Release of ESMA’s final draft for the RTS, establishing the foundation for ESEF reporting. | December 2017 |

| Regulation Implementation | The ESEF regulations were officially implemented. | June 18, 2019 |

| Mandatory Reporting | All companies listed on European regulated markets required to submit AFRs in ESEF format. | January 1, 2020 |

| Expansion to Notes Tagging | Requirement to tag all notes to financial statements with iXBRL, known as ‘Block Tagging’. | 2022 |

FAQs on ESEF Tagging

FAQs on ESEF Tagging

Is ESEF tagging mandatory?

Yes, ESEF block tagging is mandatory for all companies in the EU that are required to submit consolidated IFRS financial statements for fiscal years starting on or after January 1st, 2022.

How will ESEF tagging impact investors and other stakeholders?

ESEF block tagging is expected to improve the accessibility and usability of financial information for investors, analysts, and other stakeholders. This can lead to more informed investment decisions and better overall market transparency.

What guidance does the ESEF reporting manual offer to reduce validation errors?

To minimize validation errors, especially “false positives,” the ESEF reporting manual advises companies to tag mandatory elements only when their corresponding disclosures are present in the financial reports. This approach is aimed at ensuring that validation results accurately reflect the content of the reports, reducing unnecessary errors and enhancing the quality of financial disclosures.

Can I outsource ESEF tagging?

Yes, companies can outsource ESEF block tagging to service providers specializing in XBRL and ESEF compliance. This can be a good option for companies lacking internal expertise or resources. DataTracks stands out as a leading service provider with extensive expertise in ESEF tagging. Their deep understanding of XBRL and ESEF requirements, combined with years of experience in financial reporting and compliance solutions, makes them an ideal partner for businesses looking to navigate the ESEF compliance landscape effectively.