It’s time to file your yearly reports. Your finance team is working late to complete the 10-K, the most essential financial statement that your company publishes with the Securities and Exchange Commission (SEC). Despite the presence of skilled individuals, modern accounting systems, and established routines, mistakes continue to occur. Errors in XBRL tagging, incorrect disclosures, or last-minute revisions might lead to SEC review cycles, costly delays, and reputational harm.

But why? With technology and experience at an all-time high, shouldn’t 10-K filings be simple, dependable, and error-free?

In reality, smart finance teams continue to struggle because most firms view compliance as a process challenge rather than a data intelligence problem. This blog delves into the true causes of persistent 10-K problems and how contemporary reporting automation, structured procedures, and proactive planning may significantly improve accuracy under tight time constraints.

The SEC 10-K Filing Landscape: High Stakes, High Complexity

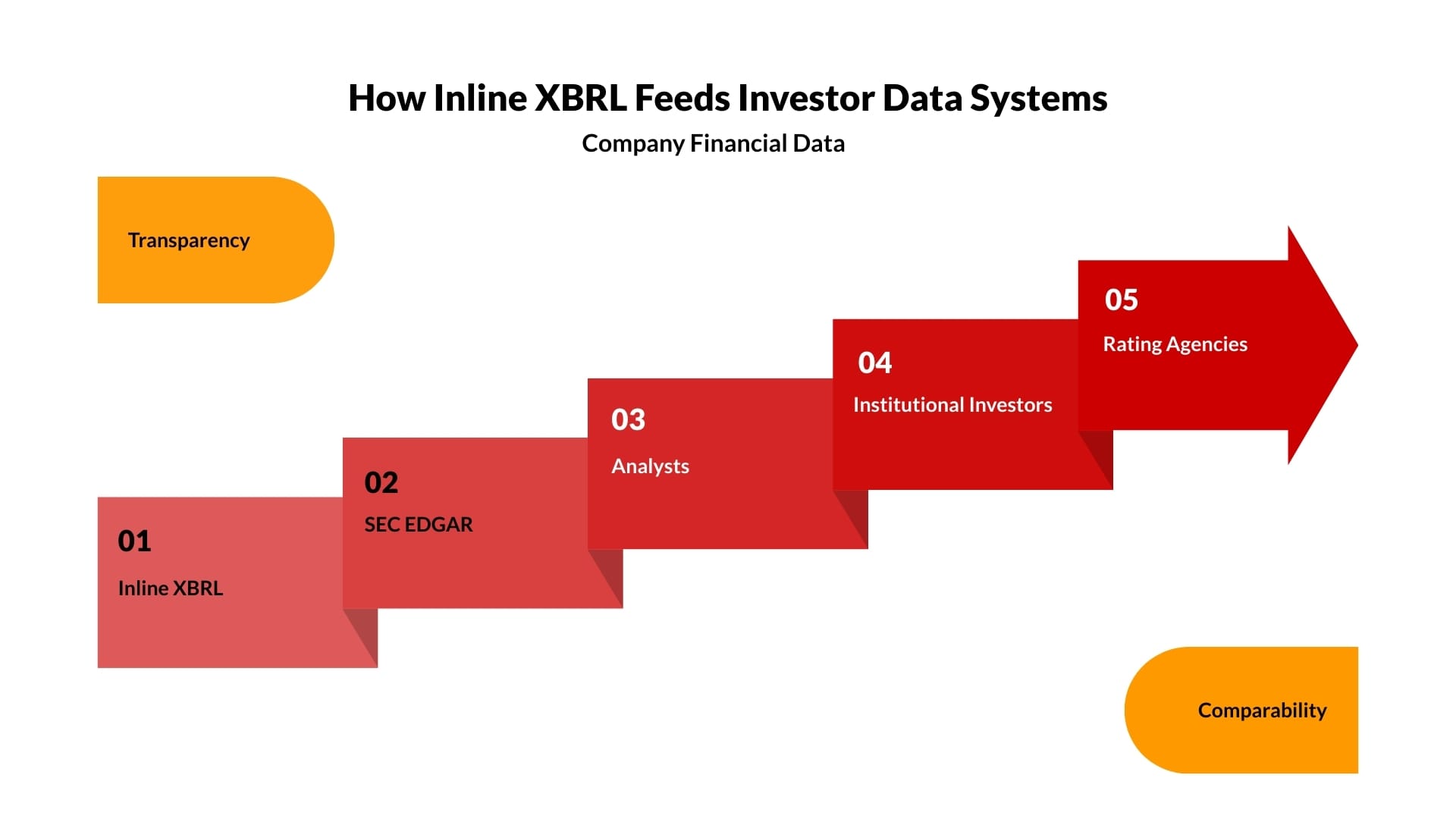

A Form 10-K is much more than just a document. It provides a comprehensive view of a company’s financial performance, business risks, governance disclosures, and regulatory compliance. Large portions of the 10-K must now be filed using Inline XBRL, a structured, machine-readable format required by the SEC.

Why Inline XBRL Matters

Inline XBRL increases transparency by enabling regulators, investors, and analysts to consume financial data automatically. While this enhances accessibility and comparability, it also raises the possibility of technical errors if the tagging is incorrect, incomplete, or misaligned with the U.S. GAAP taxonomy.

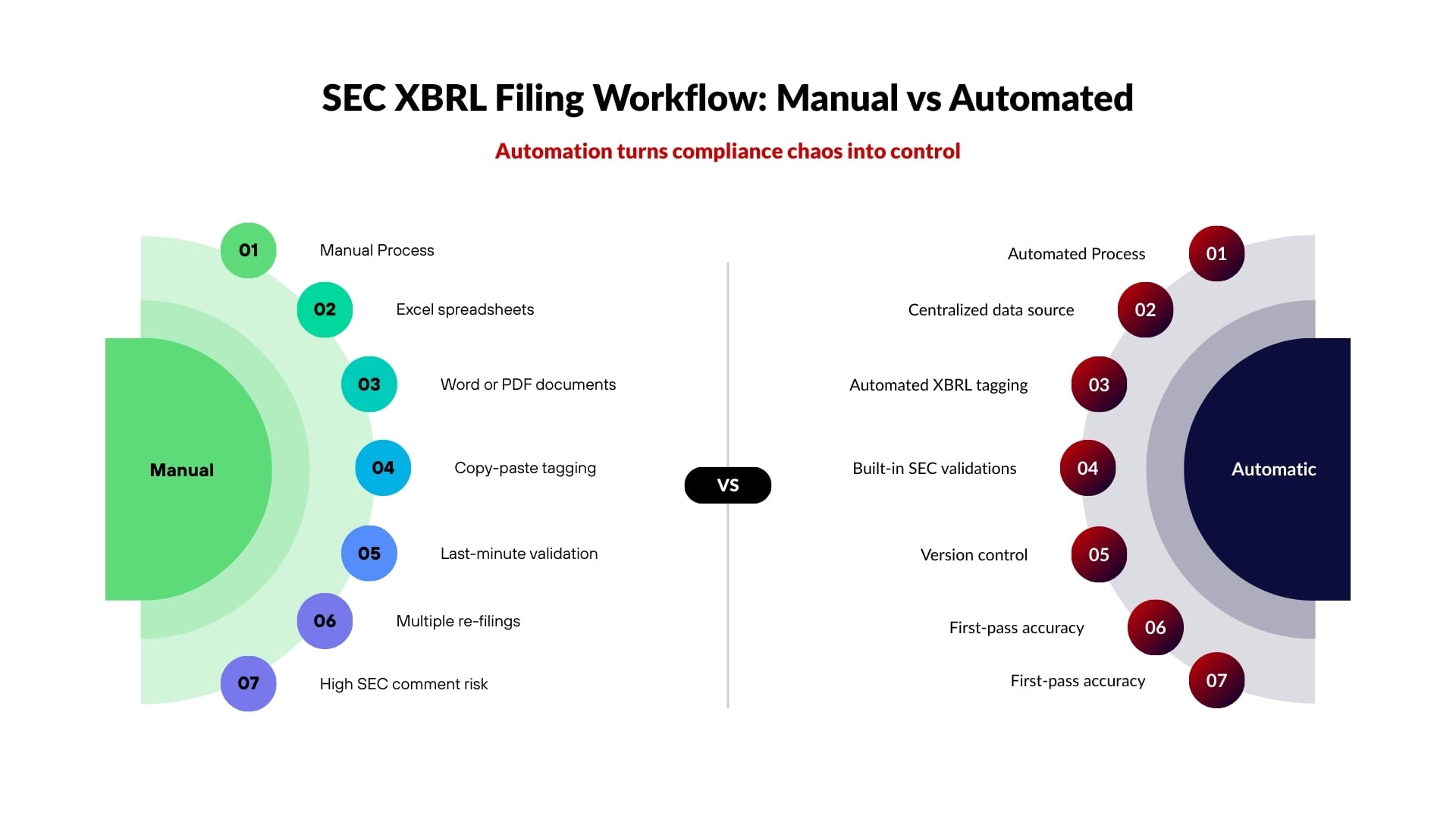

1. Manual Processes Under Extreme Time Pressure

During the filing season, many financial teams continue to use spreadsheets, manual exports, and document-based tagging. Under tight timelines, this creates the ideal environment for human errors. Incorrect labels, duplicated tags, and inconsistent taxonomy selections frequently go unnoticed.

According to research, excessive usage of custom XBRL tags, which is commonly caused by manual intervention, decreases data comparability and raises the chance of SEC investigation.

2. Constantly Expanding Disclosure Requirements

The SEC has dramatically increased XBRL requirements in recent years. Beyond typical financial statements, organizations must now label sophisticated narrative disclosures, including pay-versus-performance indicators, risk considerations, and cybersecurity disclosures.

Each additional criterion adds to the technical complexity and pushes finance teams to grasp both regulatory interpretation and structured data tagging simultaneously.

3. Gaps Between Financial Closure and SEC Reporting

Strong accounting close processes may not always result in compliant SEC filings. Financial data is frequently stored in ERP systems that are not designed to map easily into XBRL taxonomies.

Without linked reporting tools, teams must manually reconcile figures, which increases the possibility of errors between financial statements and tagged disclosures.

4. Tools That Were Not Built for SEC Compliance

Generic document tools and older reporting technologies lack SEC validation criteria. These approaches allow problems to persist until the final level of EDGAR validation, at which point corrections become hasty, expensive, and stressful.

What High-Performing Finance Teams Do Differently

1. Use Integrated SEC Reporting Platforms

Leading financial teams use purpose-driven SEC reporting tools to automate XBRL tagging, enforce taxonomy rules, and execute validations in real time. Automation minimizes monotonous processes, allowing professionals to focus on judgment, analysis, and quality disclosure.

2. Combine Automation with Expert Review

The most effective teams adopt a hybrid model that blends technology with human expertise. Best practice workflows include:

- Automated validation and taxonomy checks

- Consistent tagging standards across reporting periods

- Expert review before submission

This method greatly decreases first-time filing errors and SEC comment letters.

3. Extend Data Governance Beyond the Close

SEC reporting is integrated into high-performing firms’ enterprise data governance strategies. Clear documentation standards, controlled data definitions, and consistent taxonomy mapping across time periods prevent last-minute surprises.

4. Reuse and Validate Tags Across Reporting Cycles

Rather than rewriting the procedure each year, top teams reuse verified tags for recurrent disclosures and test filings ahead of peak deadlines. This increases consistency, efficiency, and confidence.

How DataTracks Helps Finance Teams Get 10-K Filings Right

At DataTracks, we recognize that current SEC reporting necessitates both strong technology and extensive regulatory expertise.

Comprehensive SEC Filing Services

DataTracks offers complete SEC filing solutions, including EDGAR submissions, Inline XBRL tagging, and expert support for 10-Ks, 10-Qs, registration statements, and other SEC forms.

DataTracks Rainbow SEC Reporting Software

DataTracks Rainbow is a cloud-based SEC reporting platform that simplifies inline XBRL tagging, collaboration, and validation. Built-in controls reduce manual intervention and enable teams to fulfil deadlines with ease.

Trusted Expertise Backed by Experience

With over two decades of regulatory reporting experience, DataTracks combines worldwide compliance expertise with practical solutions designed for real-world filing requirements.

Actionable Steps for Your Next 10-K Filing

To improve accuracy and reduce stress, finance teams should:

- Study the new SEC disclosure and tagging criteria early

- Enforce the use of software with an automated taxonomy

- Include internal review checkpoints in the filing timelines

- Ensure consistent tagging decisions throughout reporting periods

- Maintain comprehensive documentation for audit and future filings

These processes move SEC reporting from reactive firefighting to disciplined execution.

Conclusion

Conclusion

Accurate 10-K reporting is more than merely meeting a deadline. It’s about preserving credibility, retaining investor trust, and demonstrating strong governance. People rarely have to deal with persistent filing errors. They are a systemic problem.

By combining intelligent automation, strong governance, and skilled oversight, finance teams can transform one of the year’s most stressful reporting cycles into a predictable, controllable process.