Securities and Exchange Commission (SEC)

Do you need to prepare accurate compliance reports in HTML, XBRL/iXBRL formats for filing with the SEC?

Consider licensing our in-house software (DataTracks Rainbow) and tag content to the US GAAP and IFRS taxonomies before submitting it to the SEC. Alternatively, you may also use our fully assisted services.

Frequently Asked Questions

The U.S. Securities and Exchange Commission (SEC) is an independent federal government regulatory agency responsible for safeguarding investors, maintaining fair and orderly functioning of the securities markets, and facilitating capital formation.

SEC filings are essential regulatory documents required of all public companies to provide critical information to investors or potential investors.

SEC filings delivered through EDGAR offer transparency and crucial information for individual and institutional investors, analysts & researchers, and regulators.

Their prominence lies in empowering investors to make informed decisions, identify potential risks, and seize opportunities in the investment landscape.

SEC filings offer investors crucial information about a company’s financial performance, business plans, and risk factors.

- Annual reports (Form 10-K)

- Quarterly reports (Form 10-Q)

- (Form 8-K) – An 8-K is a report of unscheduled material events

- Proxy statements (Form DEF 14A)

- Registration statements (Form S-1, Form S-3, etc.)

- Foreign Private Issuers with listed equity shares on exchanges in the US to file 20-F annually

- Canadian Companies listed in the US to file 40-F annually

- Other filings, such as 488BPOS, Form 497 for mutual funds

The SEC requires all public companies to file their annual reports and proxy statements in iXBRL format. Quarterly reports and other filings can be filed in HTML or XBRL format, but iXBRL is preferred.

All publicly traded companies in the United States are required to file their financial statements with the SEC in iXBRL format. This means that these companies must tag their financial statements with the US GAAP Taxonomy.

Foreign private issuers (FPIs) that are listed on US stock exchanges are also required to file their financial statements with the SEC in iXBRL format. However, FPIs are not required to use the US GAAP Taxonomy. They can instead tag their financial statements with the IFRS Taxonomy or another XBRL taxonomy that is approved by the SEC.

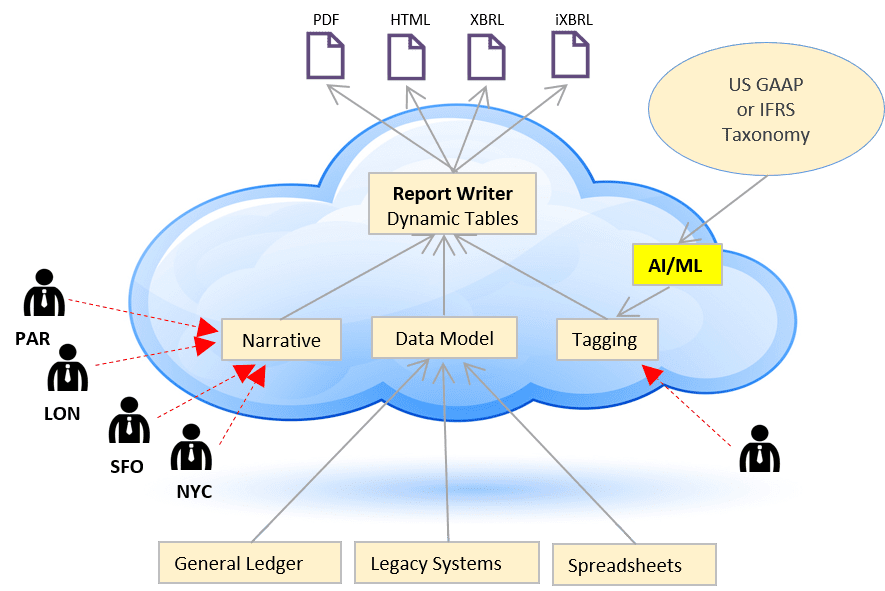

DataTracks offers a cloud-based solution called DataTracks Rainbow that can help you prepare and file your SEC reports in iXBRL format.

With DataTracks Rainbow, streamline your SEC reporting process effortlessly, collaborate and prepare error-free compliance reports under various disclosure requirements.

DataTracks Rainbow automates the process of tagging your financial data with XBRL tags, and it also provides a variety of tools to help you review and edit your reports before you file them.

The deadline to file SEC reports varies depending on the type of report.

For example, companies must submit their annual filing (10-K) within 60 to 90 days of the close of their fiscal year. The Form 10-Q must be filed for the first three quarters of the company’s fiscal year. The filing deadline is within 40 days from the end of the quarter.

The SEC can impose a variety of penalties for late SEC filings, including:

- Civil penalties of up to $25,000 per day

- Suspension of trading in the company’s securities

- Revocation of the company’s registration statement

In addition, the SEC may also take enforcement action against the company’s officers and directors for failing to file SEC reports on time.