What You Should Consider Before Selling Your Business to a SPAC

SPAC deals have been top-rated in recent years. Since the onset of the pandemic, the numbers in terms of capital raised for new investment opportunities have broken records.

For private equity sponsors who own portfolio companies, selling to a SPAC is a very lucrative means of going public as a potential exit. Complex to execute, selling to a SPAC comes with its share of keen evaluations, such as differences between an IPO, a private sale, and a sale to a SPAC. In this blog, we help you navigate a potential deal to a SPAC by throwing light on some key considerations you will need to consider.

Things to Consider Before Selling Your Business to a SPAC

Is your Portfolio Company Conducive to being a Public Company?

In plain terms, a SPAC sale is an exit strategy that replaces the traditional IPO. Therefore, you will not be able to come out of the sale with a 100% share of your company. This is an essential consideration for you to decide if your portfolio company is worth the piece-meal split, if your investors support the sale, and if your equity share will be valued well.

You will also have to consider disclosure requirements of the SEC as part of the approval process of the sale as the extent of information in financial statements may be comparable to that of an IPO prospectus.

Can Your Deal Withstand Certain Market Risks?

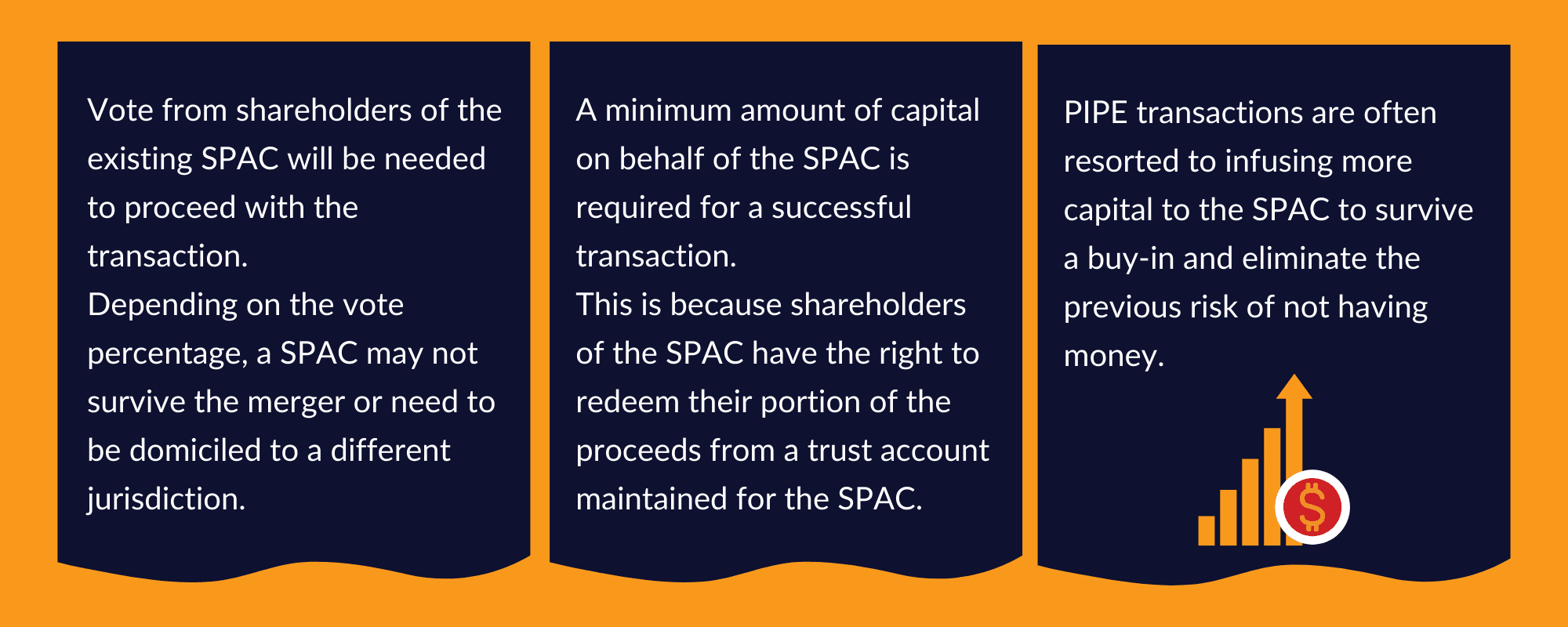

Some of the significant clauses that could cause market risks when selling to a SPAC are:

Do You Have A Plan-B?

Since the SPAC shareholders hold the purse strings in terms of the trust fund, there are few options available if the sale process fails. The least one can do to get expenses reimbursed. This will also hold if legal action is being sought as, most often, there may not be enough resources to seek damages against a SPAC. Therefore, having an alternate course of action and ensuring enough funds is crucial to consider.

Are You Prepared to Run a Public Limited Company?

It is an uphill task to pivot from one management style to a completely different one that needs new skill sets. The main point of distinction is the reporting function which needs new personnel and technology dedicated to SEC reporting. This is apart from bolstering IT, investor relations, and finance functions to meet the new requirements.

It is no secret that private company management teams have limited experience when compared to public company executives. The board of directors must be changed, and an audit committee must be formed for a privately held entity used to limited disclosure. The mountain of revelations that a public company warrants can be intimidating.

The fundamental question that you will need to ask yourself is, “Is a SPAC sale for me?” While there may be multiple risks during execution, if your portfolio company is strong enough to mold into the public market way of life, you will find that this exit strategy brings you a host of advantages. Not only will it help remove liquidity, but it will also ensure that you benefit from the appreciation of your rolled-over equity in the future.

To assess if you are ready to be taken on by a SPAC or discuss more lucrative possibilities, get in touch with us at +1 (609) 257 4232.

Send a mail to enquiry@datatracks.com or click here.