SEC’s Climate Disclosure Rule Paused: The Road So Far—and What Comes Next

In a significant development, the U.S. Securities and Exchange Commission (SEC) has paused the implementation of its much-anticipated climate-related disclosure rule. Initially designed to enhance transparency around how companies assess and manage climate risks, the rule has now become the center of legal and political controversy.

So how did we get here? Let’s walk through the timeline, industry responses, legal challenges, and what this pause really means for U.S. companies.

A Quick Timeline

March 2022 – The Proposal

The SEC unveiled a landmark rule titled:

“The Enhancement and Standardization of Climate-Related Disclosures for Investors.”

This proposal aimed to provide investors with consistent, comparable climate-related information from public companies. Key requirements included:

- Disclosure of greenhouse gas (GHG) emissions (Scopes 1, 2, and conditionally Scope 3)

- Explanation of climate-related governance and risk management

- Assessment of climate-related financial impacts

- Inline XBRL tagging of all climate disclosures

March 6, 2024 – Final Rule Announced

After extensive feedback, the SEC released a revised and more moderate final rule. Key updates included:

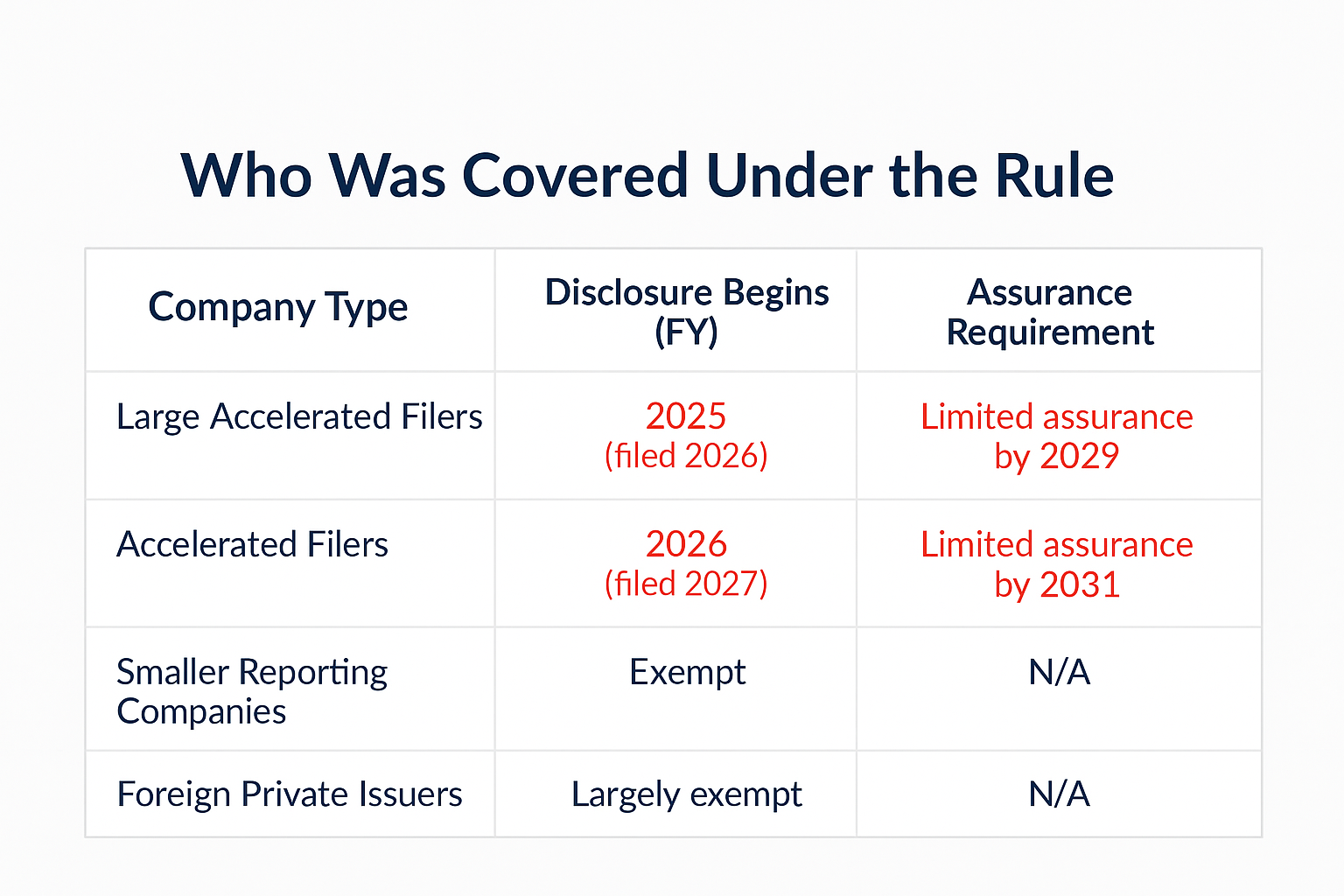

- Applies only to Large Accelerated Filers and Accelerated Filers

- Mandatory disclosure within 10-K filings

- Reporting of Scope 1 and 2 emissions only (Scope 3 excluded)

- Climate risk governance and board oversight disclosures

- Climate-related impacts to be included as footnotes in audited financial statements

- Inline XBRL tagging for structured data reporting

Corporate Response: Concerns from Public Companies

The moment the final rule was published, it triggered a wave of concern across corporate America, especially among public filers. Common concerns included:

- Compliance Burden: Companies worried about the complexity and cost of building systems to track and report emissions data, especially for those new to ESG reporting.

- Data Accuracy & Liability: Since climate data would be included in 10-Ks, there were heightened fears about liability and audit challenges.

- Readiness Gap: Many companies—particularly in retail, services, and non-energy sectors—were not operationally prepared to meet the requirements.

- Scope 3 Confusion: Although Scope 3 was excluded from the final rule, the initial proposal had already set expectations and caused resource planning challenges.

Legal Challenges & Political Pushback

Shortly after the rule’s release, it faced swift legal backlash. Lawsuits were filed by:

- State Attorneys General (especially from conservative states)

- The U.S. Chamber of Commerce

- Energy and manufacturing trade groups

Core Legal Arguments:

- The SEC had exceeded its statutory authority by regulating environmental disclosures.

- The rule imposed significant cost burdens on companies with questionable materiality.

- Climate risk was not universally material to all investors.

The lawsuits were consolidated and assigned to the 8th Circuit Court of Appeals, which will ultimately decide the rule’s fate.

April 2025 – SEC Pauses the Rule

On April 4, 2025, the SEC issued an official stay on the rule’s implementation, citing the ongoing litigation and the need to avoid regulatory confusion.

“This stay will preserve judicial resources and avoid potential regulatory confusion or premature compliance efforts.” – SEC Statement

Until the court reaches a final decision, no enforcement will occur.

What Companies Are Doing in the Meantime

Though the rule is on pause, many companies are taking a proactive approach:

- Voluntary Reporting Still Matters

Firms continue to report under TCFD, SASB, and CDP—voluntary frameworks still favored by institutional investors and international regulators.

- Building Internal ESG Infrastructure

Companies are using this time to strengthen their internal systems for:

- GHG tracking

- Scenario analysis

- Risk assessment

- Audit readiness

- Preparing for Future Mandates

Whether or not this rule survives the legal process, momentum for climate transparency isn’t fading. Many companies view ESG preparedness as a competitive advantage, not just a compliance task.

Final Thought: It’s a Pause—Not a Full Stop

The SEC may have hit pause, but expectations around climate transparency haven’t vanished. This stay reflects ongoing legal and political debate—not the end of ESG reporting.

Investors, stakeholders, and global regulators still care deeply about how companies manage climate risk. So, while enforcement is delayed, the push for disclosure continues through voluntary standards and market pressure.

The smart move?

Use this time to get ready. Build the right systems. Be transparent. That way, you’re not scrambling when the rules return—or when your investors start asking questions.

Need guidance on ESG reporting or climate disclosure readiness?

Reach out to us at enquiry@datatracks.com—we’re here to help.