Navigating the 2025 SEC Taxonomy Updates: What Businesses Need to Know

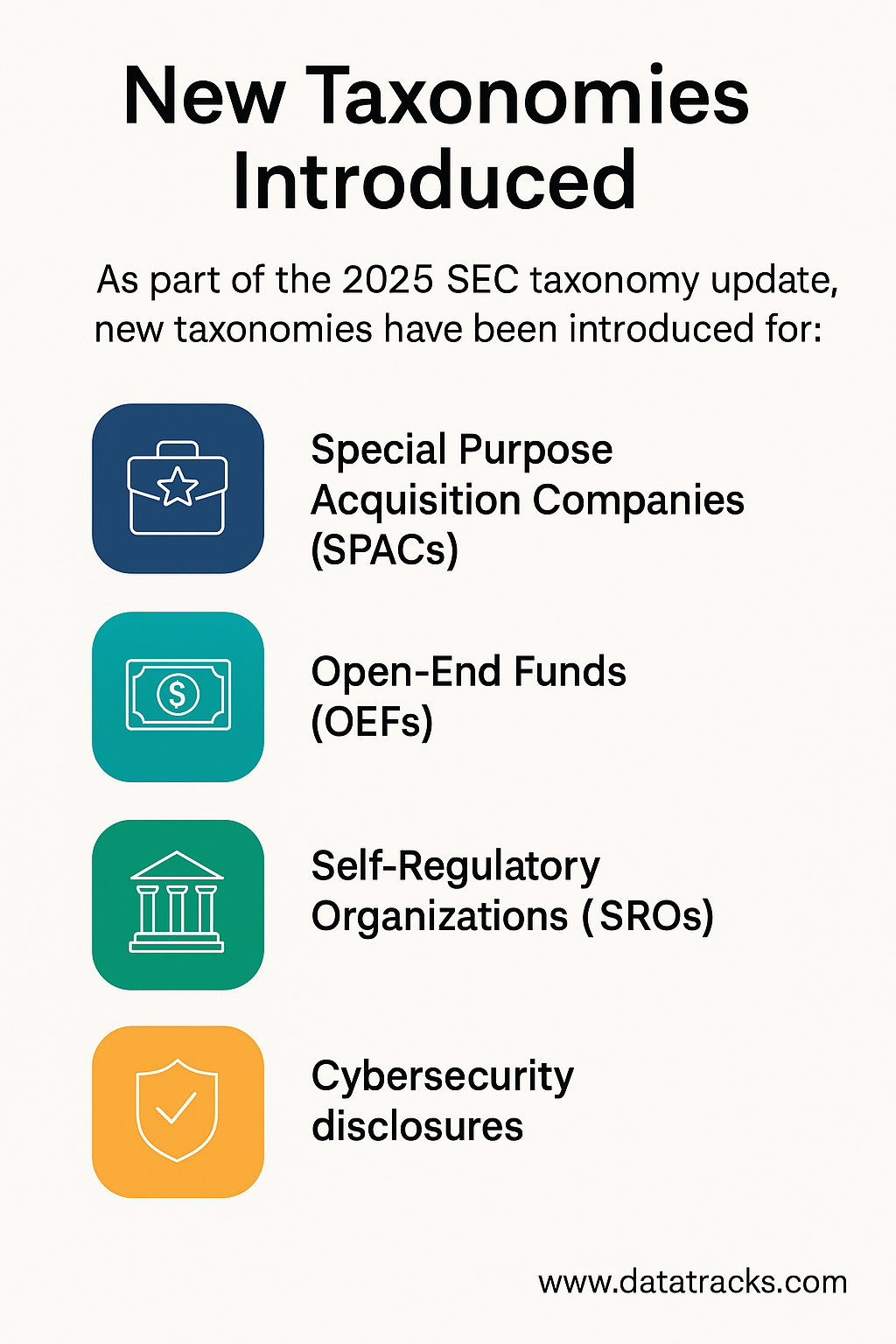

The US Securities and Exchange Commission (SEC) has introduced the 2025 XBRL taxonomies, effective March 17, 2025. This update marks another step toward improving the accuracy, consistency, and usability of digital financial reporting. As part of this update, new taxonomies have been introduced for Special Purpose Acquisition Companies (SPACs), Open-End Funds (OEFs), Self-Regulatory Organizations (SROs), and cybersecurity disclosures. Therefore, companies must adapt their reporting processes to stay compliant and maintain high-quality financial reporting.

What’s New in the 2025 SEC Taxonomies

1. Special Purpose Acquisition Companies (SPACs):

Introduction of SPAC Taxonomy: The SEC has developed a dedicated SPAC taxonomy to accommodate enhanced disclosure requirements for SPAC IPOs and de-SPAC transactions. This taxonomy includes elements necessary for tagging disclosures related to conflicts of interest, sponsor compensation, dilution, and other critical information. 2. Open-End Funds (OEFs):

Enhancements to OEF Taxonomy: The 2025 OEF taxonomy introduces a Coregistrant axis, allowing a single filing to identify multiple trusts with different Central Index Key numbers. Additionally, it permits the use of the Share Class axis in Performance Management and Fees and Expenses sections, and supports dimensional use of the Supplement to Prospectus text block element. 3. Self-Regulatory Organizations (SROs):

Modifications to SRO Taxonomy: The updated SRO taxonomy relocates certain definition links from the core schema to the related entry point schema, streamlining the taxonomy structure. 4. Cybersecurity Disclosures:

Emphasis on Cybersecurity Reporting: While a specific taxonomy for cybersecurity disclosures isn’t detailed, the SEC has prioritized cybersecurity practices, focusing on protecting investor information and ensuring robust policies for data loss prevention and incident response. Why These Updates Matter

Each year, the SEC refines taxonomies to keep pace with changing financial reporting needs and regulatory expectations. This year is no exception. The 2025 updates reflect recent changes in accounting standards and introduce enhanced validation rules through the Data Quality Committee Rules Taxonomy (DQCRT). As a result, the goal is to improve consistency and reduce discrepancies caused by different tagging practices.

In addition, the Financial Accounting Standards Board (FASB) has confirmed SEC acceptance of the 2025 U.S. GAAP Financial Reporting Taxonomy, the SEC Reporting Taxonomy, and the Employee Benefit Plan Taxonomy. Together, these updates ensure businesses can submit structured, decision-useful data to regulators, analysts, and investors.

The Challenge of Transitioning to New Taxonomies

While taxonomy updates aim to improve reporting quality, they can also present challenges. For instance, companies must carefully remap their financial statements to align with the new taxonomy structure. This process requires attention to detail and a thorough understanding of tagging requirements.

However, incorrect tagging or failure to follow new validation rules can lead to SEC comment letters or even the need to refile submissions. Consequently, this could result in delays and increased compliance costs.

How Disclosure Management Solutions Simplify the Transition

Given these complexities, it’s essential for companies to have the right tools in place. A reliable disclosure management solution simplifies the transition by automatically incorporating the latest taxonomy updates, running validations, and assisting with accurate tagging.

Moreover, such solutions save time, reduce errors, lower risk, and support seamless SEC submissions. Therefore, businesses using technology-driven platforms are better positioned to adapt to changes in regulatory requirements.

About DataTracks

With two decades of experience in regulatory compliance and XBRL reporting, DataTracks supports organizations across 26 countries. To support the 2025 changes, we’ve updated our disclosure management platform to fully support the new SEC taxonomies.

Through features like automated validation, guided tagging, and expert support, we help businesses ensure smooth, efficient adoption of new taxonomy structures. As always, our goal is to make complex reporting simple.

Contact Us

For more information, reach out to us at enquiry@datatracks.com