Top 10 New Changes to Company Law Introduced in 2022

With the unpredictable last few years, many countries across the world face the dual challenge of stimulating growth in fragile economies while trying to implement fiscal discipline. The potential of an economic downturn and the predicted slump in the pace of growth recovery have long-term implications not only for employment but also for competitiveness and business enterprise.

In the UK, like the rest of the world, businesses – both large and small – are competing for credit and capital, while banks, financial institutions, and private investors are now much more cautious in their investment decisions.

In this situation, therefore, it has become increasingly important for businesses to be financially transparent and for governments to establish a sound regulatory environment for corporate financial reporting.

Working towards this goal, certain suggestions have been made whereby limited companies, their directors, and their ‘persons with significant control (PSCs) will soon have to comply with many significant new company law rules.

10 New Changes by UK HMRC on Company law in 2022:

Change 1

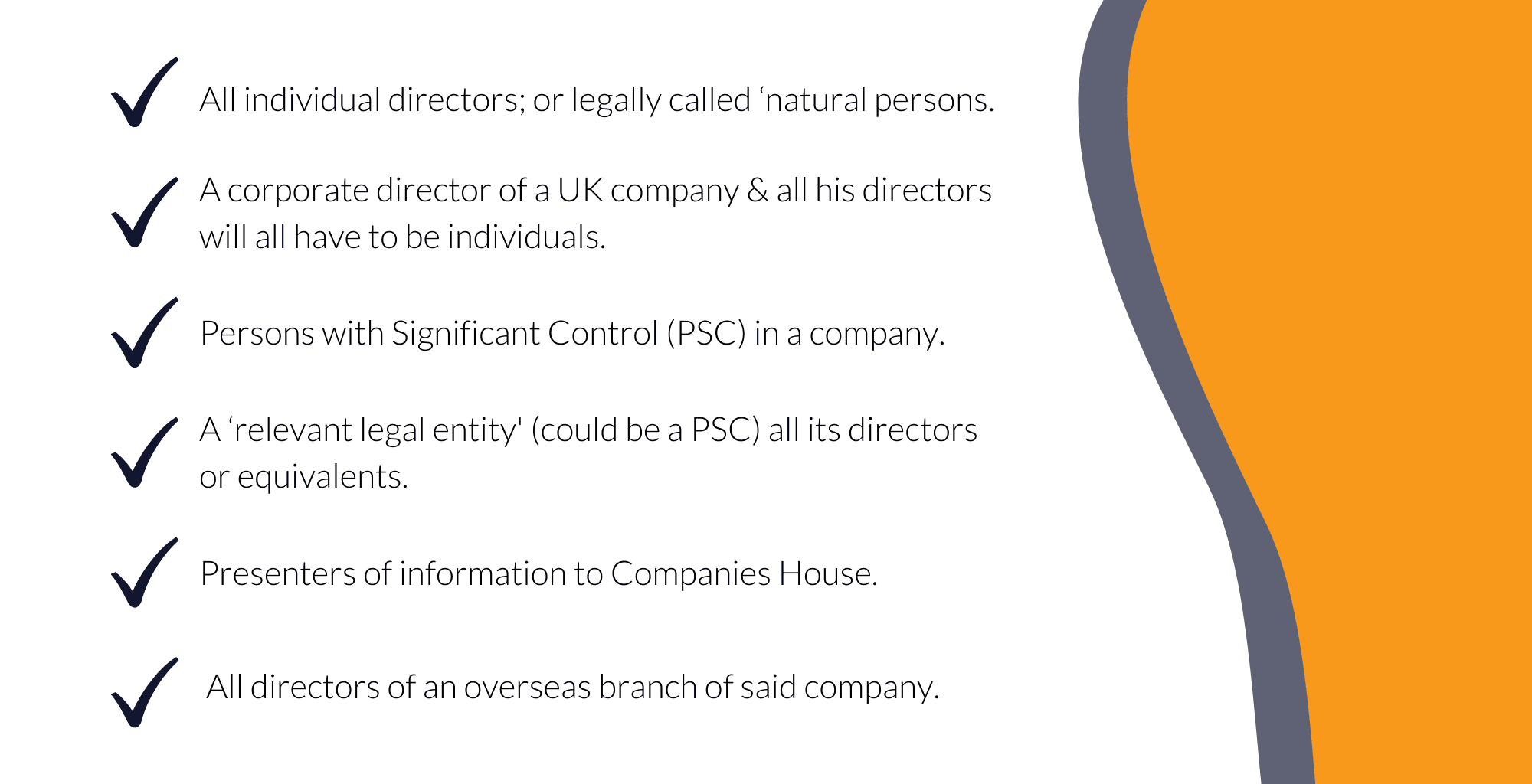

One of the principal reforms will be a requirement for Companies House to create a ‘verification account’ in order to verify the identity of:

Verification is mandatory for all new directors and PSCs before they can be registered. If they are already registered with Companies House, they will have to undergo a transitional period within which they must get their identities verified by Companies House. The verification process will be digital, with records of photos, names, and designations stored as data for easy access and analysis.

Change 2

Companies House will be given the right to ask for information and submit queries on any data, more so if it appears to be connected to fraudulent, suspicious, or malicious activity or activity that might otherwise impact the integrity of the register. For instance, ‘phoenix’ companies that are set up to defraud creditors.

Change 3

The nomenclature for the company name is being widened along with the need to justify the name before they can be used, for example, words from other languages and abbreviations. Special characters and punctuations will also be allowed.

Change 4

The concept of digital filing and iXBRL ‘tagging’ has been made mandatory for all accounts submitted to Companies House. This move will ensure that data can be easily compared with online tax returns for consistency.

Change 5

The change relating to transparency for small and micro companies is two-fold.

It is proposed that there will be filing options for micro and small companies to simplify complexities in current filing options…but the options for abridged or “filleted” accounts will be removed. Micro-entities will retain an exemption from the requirement to prepare or file a directors’ report, however.

Change 6

In the paper, the government states that it is working towards a process that enables companies to file their financial information for different agencies and departments at the same time, once a year.

Change 7

Accounting reference periods and shortening them will be subject to modified regulations.

Change 8

The new mandate will include an extension that allows for confidential information to be guarded due to the rising instances of identity theft, domestic abuse, etc. These new powers will apply to both newly filed and existing information on the register. In particular, a procedure to suppress ‘sensitive addresses’ from the public register, such as a women’s refuge’s address, will be introduced.

Change 9

Companies House will be given an extension on its powers to share data with law enforcement agencies, regulatory bodies, and insolvency practitioners.

Change 10

Companies House will also have extended powers to check data submitted to it against data held in other databases, such as the Passport Office and/or DVLA databases.

Although it is still unclear as to when these rules will be put into force, there is a lot of work to be done in order to ensure that your organization is fully equipped to comply with these new laws. A reliable service provider like DataTracks can aid you in identifying key amendments that are required in your documents, accounts, and data. Our expertise can be leveraged to convert all your information to the mandated iXBRL language accurately and without any hassles. As more sensitive financial information may now be available to the public and law enforcement, it is even more important for your company to open your books to a trusted provider who understands the nuances of regulatory reporting.

DataTracks, a pioneer recognized by HMRC as an iXBRL expert, serves over 28,000 companies globally, simplifying statutory reporting through its cloud-based iXBRL tagging services. These services ensure accurate and compliant financial statements for regulatory filings.

Partnering with a trusted service provider like DataTracks can significantly ease this transition. With our expertise in iXBRL tagging and deep understanding of regulatory requirements, we help businesses seamlessly convert their financial information to comply with the new mandates. Our cloud-based services ensure that your filings are accurate, timely, and compliant, allowing you to focus on your core business activities.

Embrace these regulatory changes as an opportunity to enhance your company’s transparency and operational efficiency. Leverage our experience and technology to stay ahead in the evolving landscape of corporate financial reporting. Contact DataTracks today to ensure your company is prepared for the future of regulatory compliance.