Understand the Different XBRL Types – Simplified, Full, and Statement Highlights XBRL

Table of Contents

- Understand the Different XBRL Format Types – Simplified, Full, and Statement Highlights XBRL

- Simplified XBRL Format

- Who Needs to Prepare Simplified XBRL?

- Who Needs to Prepare Full XBRL?

- Who Needs to Prepare Financial Statements Highlights (FSH)?

Under the Companies Act, all Singapore incorporated companies must file their financial statements with Accounting and Corporate Regulatory Authority (ACRA), except for companies exempted from doing so. The companies that are not required to file their FS in XBRL format with ACRA include sole proprietorships, partnerships, limited liability partnerships, and limited partnerships.

The different XBRL filing requirements of financial statements vary depending on the size of the firm and its operations. Even though every company needs to file in the XBRL format, some need to file a complete set of FS whereas others are only required to file key financial data with a signed copy of complete FS in PDF.

Understand the Different XBRL Format Types – Simplified, Full, and Statement Highlights XBRL

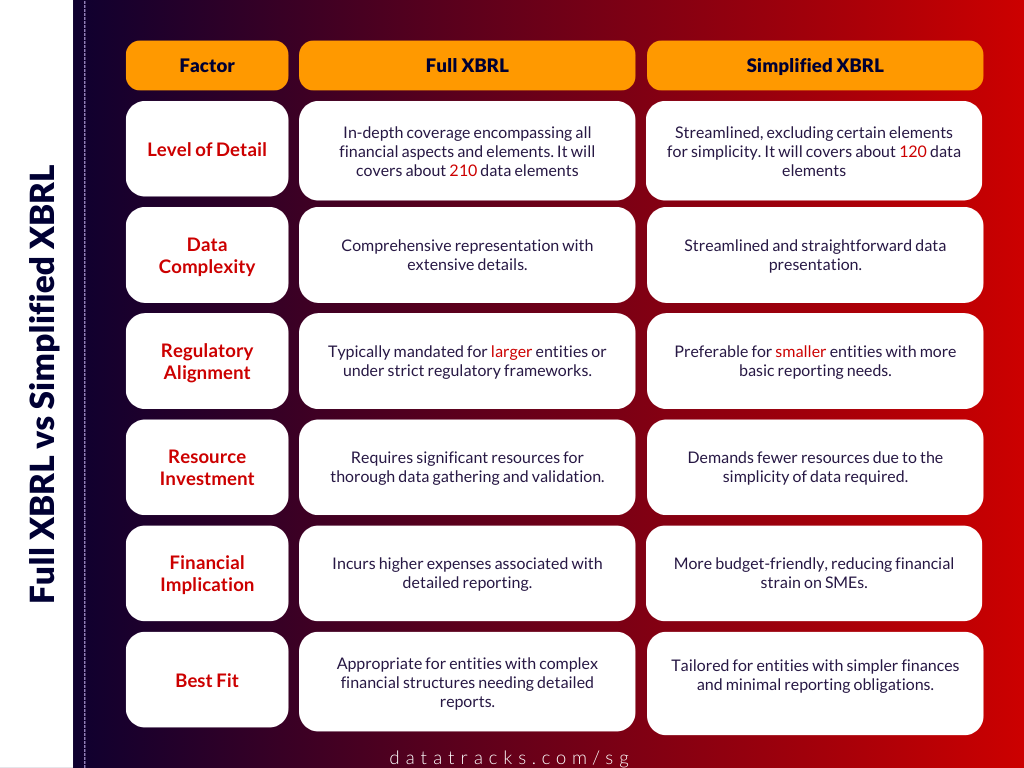

ACRA introduces four specialized XBRL format types to address the diverse financial reporting requirements across various companies and industries. These formats include Full XBRL, Simplified XBRL, XBRL FSH for Banks, and XBRL FSH for Insurance, each designed with specific features to streamline and enhance the accuracy of business reporting.

Simplified XBRL Format

Targeted towards smaller and privately held companies in Singapore, the Simplified XBRL format presents a streamlined alternative with around 120 data elements. This format is optimized for businesses requiring a less complex method to report essential financial information while still providing a complete set of financial statements in PDF. It ensures efficiency and comprehensiveness in financial reporting for smaller entities, making the process more manageable.

Who Needs to Prepare Simplified XBRL?

Small and non-publicly accountable companies are given the advantage of filing their FS in a simplified XBRL format and a PDF copy of the FS authorized by its directors. But what is simplified XBRL? It has about 120 data elements and captures the complete information about the financial performance and position of the company.

And what are small companies? A smaller company is when the revenue and total assets in the financial statements for the current year do not exceed S$500,000, respectively.

Full XBRL Format for Financial Reporting

The Full XBRL format stands out as the most comprehensive option for entities necessitating a detailed filing of their financial statements in alignment with the foundational XBRL properties. It encompasses approximately 210 data elements, enabling entities to meticulously upload primary statements along with select notes, thus facilitating accurate and accessible financial data for stakeholders such as regulators and investors.

Who Needs to Prepare Full XBRL?

All companies other than small and non-publicly accountable must file their FS in a full XBRL format. The number of data elements in full XBRL has been reduced by 50% to about 210 elements. However, it is still more as compared to simplified XBRL.

XBRL FSH Format for Banks

The XBRL FSH format tailored for banks encompasses about 80 data elements, specifically curated to cater to the banking sector’s unique reporting needs.

XBRL FSH Format for Insurance Companies

Designed to streamline reporting for insurance firms, the XBRL FSH format for insurance companies incorporates approximately 80 data elements.

Who Needs to Prepare Financial Statements Highlights (FSH)?

As per ACRA’s revised guidelines, XBRL FSH (General) is no longer available under XBRL filing requirements mandated from 1 May 2021. XBRL FSH’s banks and insurance templates have around 80 data elements each.

Companies that need to file financial statements highlights in the XBRL format together with PDF copy of authorized financial statements include:-

- Commercial Banks (full banks, wholesale banks, offshore banks)

- Merchant Banks

- Finance Companies listed under Finance Companies Act

- Licensed Insurance Companies regulated by MAS (Monetary Authority of Singapore)

There are two types of financial statements that can be filed in the XBRL formats mentioned above, let’s try and understand these:-

Standalone and Consolidated Financial Statements

Standalone financial statements reflect the financial position of single entity.

On the other hand, consolidated financial statements are prepared by companies that have other legal subsidiaries. In these FS, the financial position of all the subsidiaries is taken into account. The primary purpose of preparing consolidated financial statements is to provide an accurate and fair picture of the company’s overall financial performance as well as to ensure compliance with Singapore Financial Reporting Standards (SFRS). To know more about the companies that need to prepare consolidated FS, read here.

Seek Professional Guidance to Meet ACRA’s XBRL Filing Requirements

Understanding and preparing your financial statements in compliance with the ACRA filing requirements can seem intimidating and tedious.

However, with a trusted XBRL partner like DataTracks by your side, you can leave your filing worries at bay. An experience of 19+ years and 400,000 reports has helped DataTracks gain prowess in converting financial statements into XBRL format to comply with each and every ACRA filing requirement as well as the Singapore taxonomy.

To know more about their services, speak to a DataTracks expert at 65-31-583-654 or email @ enquiry@datatracks.com.sg

Frequently Asked Questions on XBRL Format

How many types of XBRL formats does ACRA offer, and who are they for?

ACRA offers four distinct XBRL formats: Full XBRL, Simplified XBRL, XBRL FSH for Banks, and XBRL FSH for Insurance. These formats cater to diverse needs, ranging from comprehensive financial reporting by larger companies to simplified reporting for small businesses, banks, and insurance companies. This flexibility in reporting formats demonstrates the benefits of XBRL in accommodating different levels of complexity and specific industry requirements, thereby enhancing the efficiency and accuracy of financial disclosures across various sectors.

What is the Full XBRL format, and what are its key features?

The Full XBRL format is designed for entities requiring detailed financial statement filings, including primary statements and selected notes. It contains approximately 210 data elements, ensuring precise and accessible financial reporting for various stakeholders.

Who should use the Simplified XBRL format, and what does it offer?

The Simplified XBRL format is intended for smaller businesses and non-publicly traded companies in Singapore. It provides a streamlined option with around 120 data elements, allowing these companies to file essential financial information efficiently while also submitting a full set of financial statements in PDF format.

What is the XBRL FSH format for banks, and what advantages does it bring?

Tailored for banks, the XBRL FSH format contains about 80 data elements, meeting the unique reporting requirements of the banking sector.

How does the XBRL FSH format for insurance companies improve business reporting?

The XBRL FSH format for insurance companies, with approximately 80 data elements, is designed to facilitate precise and expedient reporting of financial information.

Can the Simplified XBRL format be used by any company?

The Simplified XBRL format is specifically aimed at smaller and privately-held companies in Singapore. It is not intended for publicly traded companies or those that require detailed financial reporting beyond its scope. Also, a company whose revenue and total assets for the current financial year do not exceed S$500,000.

How do companies benefit from using XBRL formats for their financial reporting?

Companies benefit from using XBRL formats through enhanced accuracy in financial data reporting, streamlined reporting processes, improved regulatory compliance, and greater accessibility of financial information to stakeholders, leading to better decision-making.