Audit Exemption in Malaysia: Key Criteria and MBRS XBRL Filing Requirements

In Malaysia, under the Companies Act 2016, certain companies can qualify for audit exemption, particularly those companies that meet specific criteria such as being dormant, having zero revenue, or falling below certain financial thresholds. This audit exemption is designed to ease the compliance burden on smaller and inactive companies, allowing them to focus on business growth without the additional costs and complexities of conducting audits.

Let’s explore the types of companies that qualify for audit exemption, the criteria that must be met, and how MBRS XBRL filing still plays a critical role in the compliance process for these companies.

Criteria for Audit Exemption in Malaysia

All companies in Malaysia, including those exempt from audits, are still required to file financial statements through MBRS XBRL with the SSM. There are no audit-exempt companies in Malaysia that are entirely exempt from MBRS XBRL filing obligations. Audit exemption applies only to the audit process, not to the financial reporting requirement through MBRS XBRL.

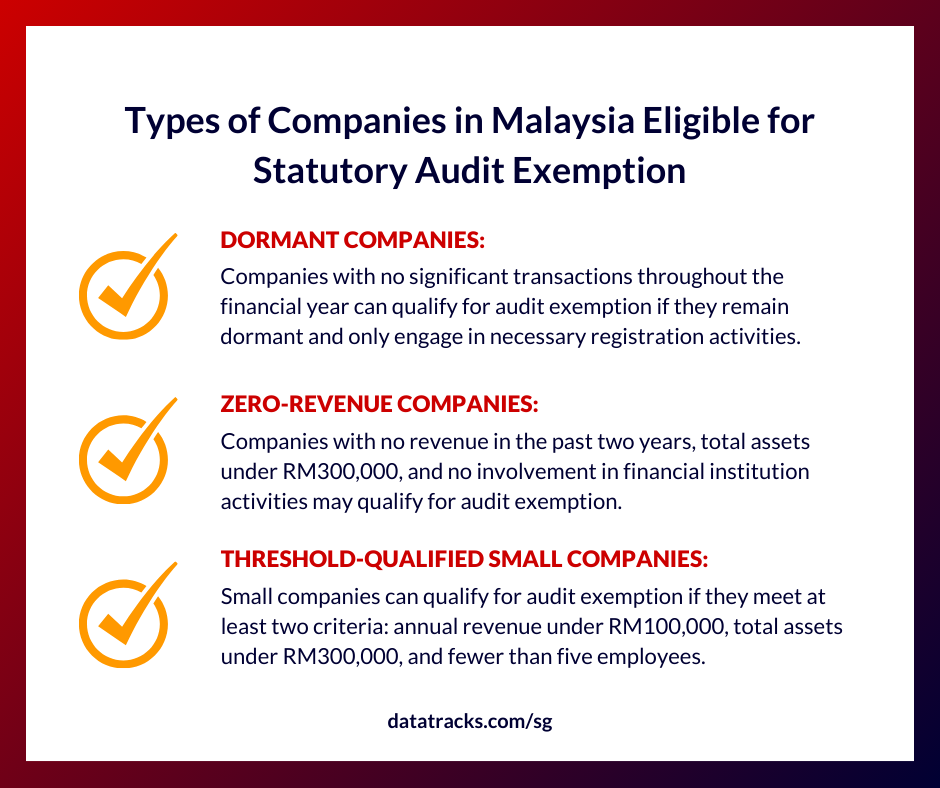

The following types of companies may be exempt from statutory audits, provided they meet specific conditions:

-

Dormant Companies

A company is classified as dormant if it has had no significant accounting transactions throughout the financial year. To qualify for audit exemption, the company must:

- Remain dormant for the entire financial year.

- Have no business activities other than those necessary to maintain its registration (e.g., paying annual registration fees to the Companies Commission of Malaysia (SSM)).

-

Zero-Revenue Companies

These companies qualify for audit exemption if they have not generated any revenue in the past two financial years. Additional criteria include:

- No revenue recorded in the last two consecutive financial years.

- The company’s total assets do not exceed RM300,000 at the end of the financial year.

- The company is not involved in financial institution activities or classified as a public company.

-

Threshold-Qualified Small Companies

Certain small private companies are eligible for audit exemption if they meet at least two of the following conditions for two consecutive financial years:

- Annual revenue does not exceed RM100,000.

- Total assets do not exceed RM300,000.

- The company employs no more than five people at any given time during the financial year.

Read more: New Audit Exemption Rules for the Private Companies in Malaysia in 2024

The Role of MBRS XBRL in Audit-Exempt Companies

Although audit-exempt companies in Malaysia are relieved from conducting statutory audits, they are still required to comply with the financial reporting obligations set by the SSM. This is where MBRS (Malaysian Business Reporting System) and XBRL (eXtensible Business Reporting Language) come into play.

MBRS XBRL filing is mandatory for all companies, including those that qualify for audit exemption. Here’s why MBRS XBRL remains essential:

-

Simplified Compliance

Even without an audit, companies must still file financial statements with SSM via the MBRS portal. These financial statements must be submitted in XBRL format, which standardizes financial data for easier analysis and regulatory oversight. MBRS allows companies to submit simplified financial statements or financial highlights in a structured format.

-

Accurate Financial Reporting

XBRL provides a standardized language for the electronic transmission of business and financial data. For audit-exempt companies, submitting financial data in XBRL format ensures that their reporting remains accurate, transparent, and easy for SSM to analyze.

-

Transparency and Accountability

While audit exemption reduces the administrative burden, it does not eliminate the need for proper financial reporting. The use of XBRL ensures that financial data is properly tagged, providing SSM and other stakeholders with a clear and standardized view of the company’s financial position.

-

Regulatory Compliance

Failure to comply with MBRS XBRL filing requirements, even for audit-exempt companies, can result in fines, penalties, or even deregistration. It is crucial for audit-exempt companies to remain compliant by ensuring that their financial statements are filed correctly and on time.

Consequences of Non-Compliance

Even though companies may be exempt from audits, they must still file their financial statements through MBRS. Non-compliance with this requirement can result in:

- Fines and penalties imposed by SSM.

- Deregistration from the SSM register, which would render the company non-operational.

- Legal action against directors and officers for failure to meet regulatory obligations.

How DataTracks Can Help

To ensure smooth compliance with MBRS XBRL filing, even for companies exempt from audits, DataTracks provides professional XBRL conversion services. With DataTracks, companies can:

- Accurately convert financial statements into XBRL format for submission via MBRS.

- Ensure compliance with SSM requirements, minimizing the risk of penalties.

- Receive expert support for seamless financial reporting.

Our XBRL experts are well-versed in the intricacies of MBRS filing, ensuring that your company’s submissions are error-free and compliant with all regulatory standards.

Conclusion

Audit exemption in Malaysia offers substantial benefits to dormant, zero-revenue, and small companies by reducing costs and administrative burdens. However, these companies must still comply with financial reporting obligations under MBRS, ensuring that their financial statements are accurately filed in XBRL format.

For hassle-free MBRS XBRL conversion and submission, reach out to DataTracks. Our experts are ready to help your company stay compliant and ensure accurate, timely submissions.

Need MBRS XBRL filing assistance? Contact DataTracks today!