12 Regulations. 19 years. 26 countries. 28,000+ clients. 400,000 reports.

12 Regulations. 19 years. 26 countries. 28,000+ clients. 400,000 reports.

DATATRACKS

CRD IV Reporting Solution

For Banks and Investment Firms

The CRD IV Mandate Explained

In 2013, a new directive was introduced by the EBA (European Banking Authority) to restore the transparency of financial data being reported by banks, financial institutions and investment firms. The directive is known as the CRD IV Reporting Directive, and it encompasses standardised reporting requirements of a company’s minimum capital requirements, which are referred to as COREP and FINREP. As per the CRD IV (Credit Requirements Directive) mandate, Banks and Financial Institutions across the European Union and the UK are required to submit detailed financial information to their national supervisors. The framework of this reporting directive requires each eligible entity to transmit data in XBRL format, before final submission to the local authority and the EBA.

When the CRD IV Reports be Filed?

The reports are required to be filed at different intervals, depending on the type of report and the category of the filer. The frequency of submission is mostly on a monthly or quarterly basis. The submission deadline is normally around 14 days from the end of the reporting period for monthly submissions, and 40 days from the end of the reporting period for quarterly submissions.

CRD IV Reporting Solutions

The banking, financial and insurance sectors are facing increasingly onerous and varied CRD IV requirements, driven by the EBA or the FCA. Furthermore, the additional rules and requirements related to managing digital risk and operational resilience make it more challenging for eligible entities to prepare and furnish quality XBRL reports.

By leveraging a robust solution that allows financial institutions and investment firms to meet COREP, FINREP and other reporting requirements, this mandate aims to maintain a transparent and quality reporting structure.

How to Choose the Right CRD IV Reporting Solution

Since the introduction of the mandate, financial firms have been facing increased complexity and an overall increase in the burden, in terms of compliance. This is why there is a need to find the right solution.

What are the essential facets of the CRD IV Reporting solution you should look out for?

- Ability to handle a large volume of data instantly

- Flexibility to link with external data resources for quick data input

- Comprehensive validation engine with the ability to trace back to templates

- Better explanation of validation errors for user understanding

- Multiple-user workflow with defined category and user authorisation

- Automatic taxonomy updates in compliance with the latest EU and EBA reporting requirements

- User-friendly cloud-based solution

- Prompt support during the filing process

Challenges in CRD IV Reporting

Financial institutions and investment firms face several challenges in meeting the CRD IV Reporting requirements, including:-

Increased Complexity

The banks are required to submit several reports to the FCA and the EBA, including ALMM and LCR DA modules, on a monthly basis, and LE, LR, NSFR, FINREP on a quarterly basis. This requires a large volume of highly granular data to be collated, which increases the complexity of the financial reports to be submitted. Sourcing the data from different systems and consolidating the data as per the requirements for each template is a challenge for businesses.

Managing Digital Risk

Since the introduction of the draft legislation by the EU, fulfilling risk requirements has become a significant challenge for financial firms, which now have to manage digital risk as per the new Digital Operational Resilience Act (DORA).

Data Preparation, Formatting and Validation

The data preparation for all the CRD IV reports is done manually, which means it is highly prone to errors. Furthermore, the COREP and FINREP reports require effective pre-submission formatting, normalisation, and validation of reporting data, which is a highly meticulous task, considering the technical standards and quality checks of the EBA and the FCA.

How to Choose the Right CRD IV Reporting Solution

Since the introduction of the mandate, financial firms have been facing increased complexity and an overall increase in the burden, in terms of compliance. This is why there is a need to find the right solution.

What are the essential facets of the CRD IV Reporting solution you should look out for?

- Ability to handle a large volume of data instantly

- Flexibility to link with external data resources for quick data input

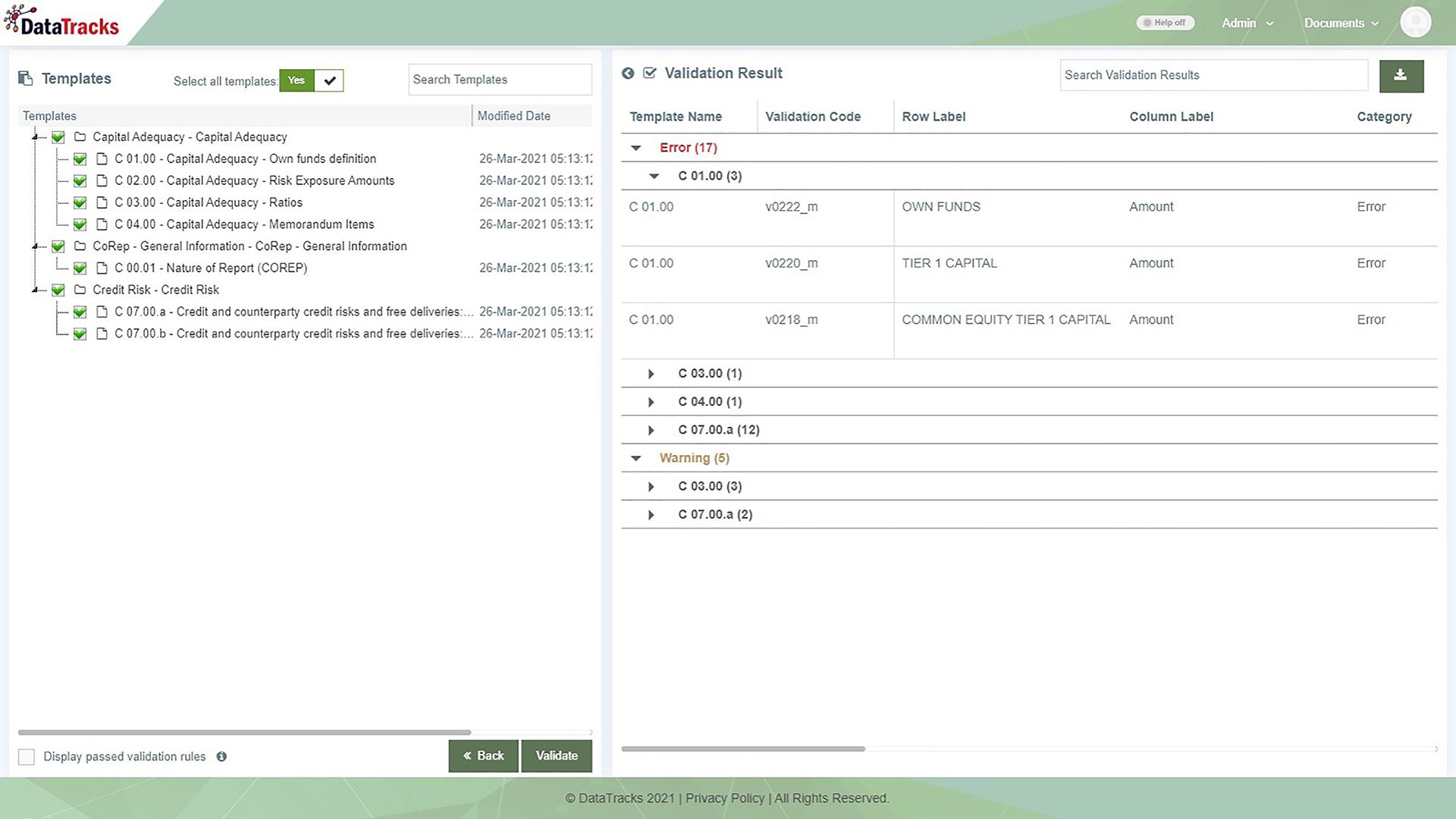

- Comprehensive validation engine with the ability to trace back to templates

- Better explanation of validation errors for user understanding

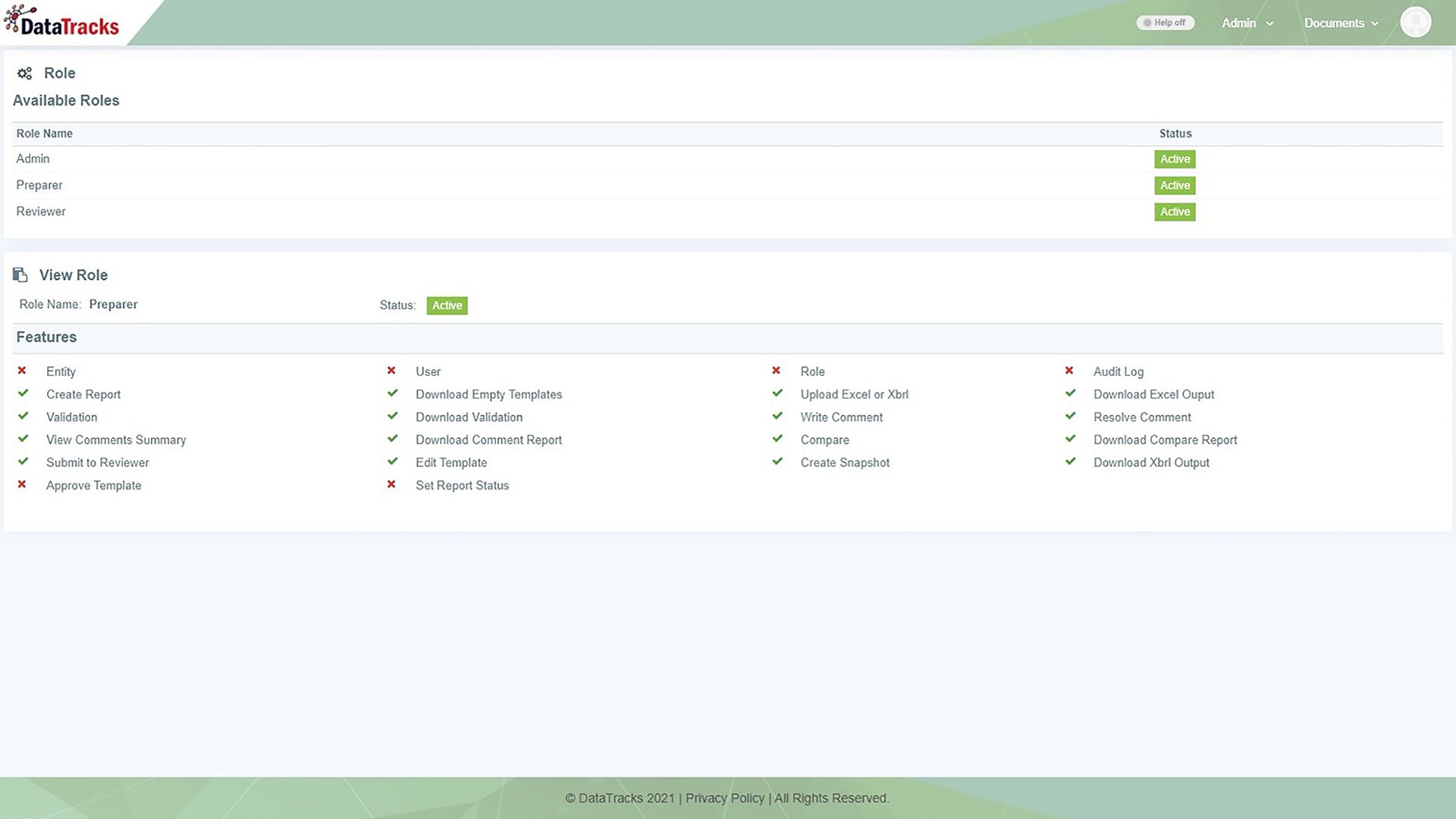

- Multiple-user workflow with defined category and user authorisation

- Automatic taxonomy updates in compliance with the latest EU and EBA reporting requirements

- User-friendly cloud-based solution

- Prompt support during the filing process

How DataTracks can help?

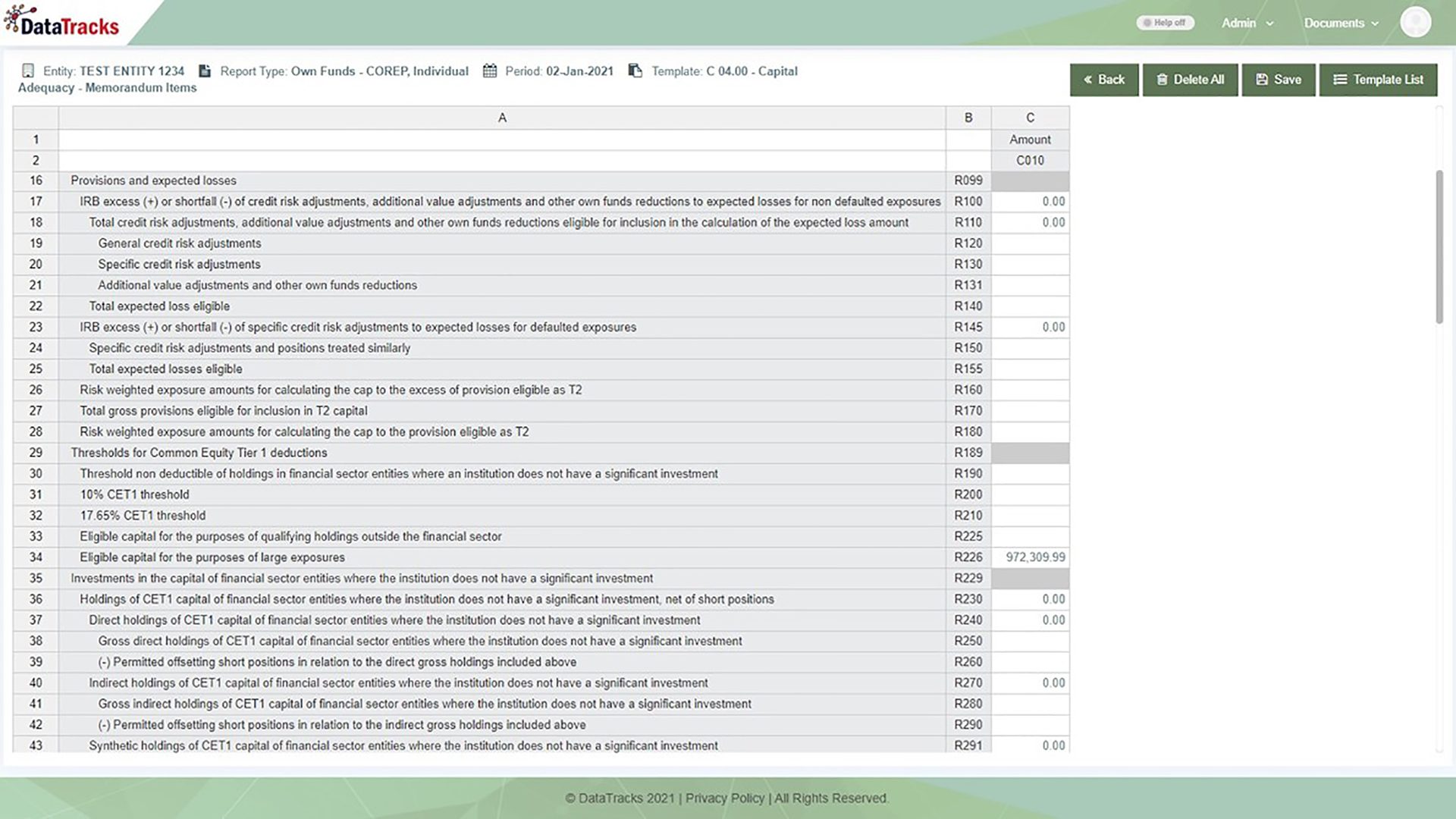

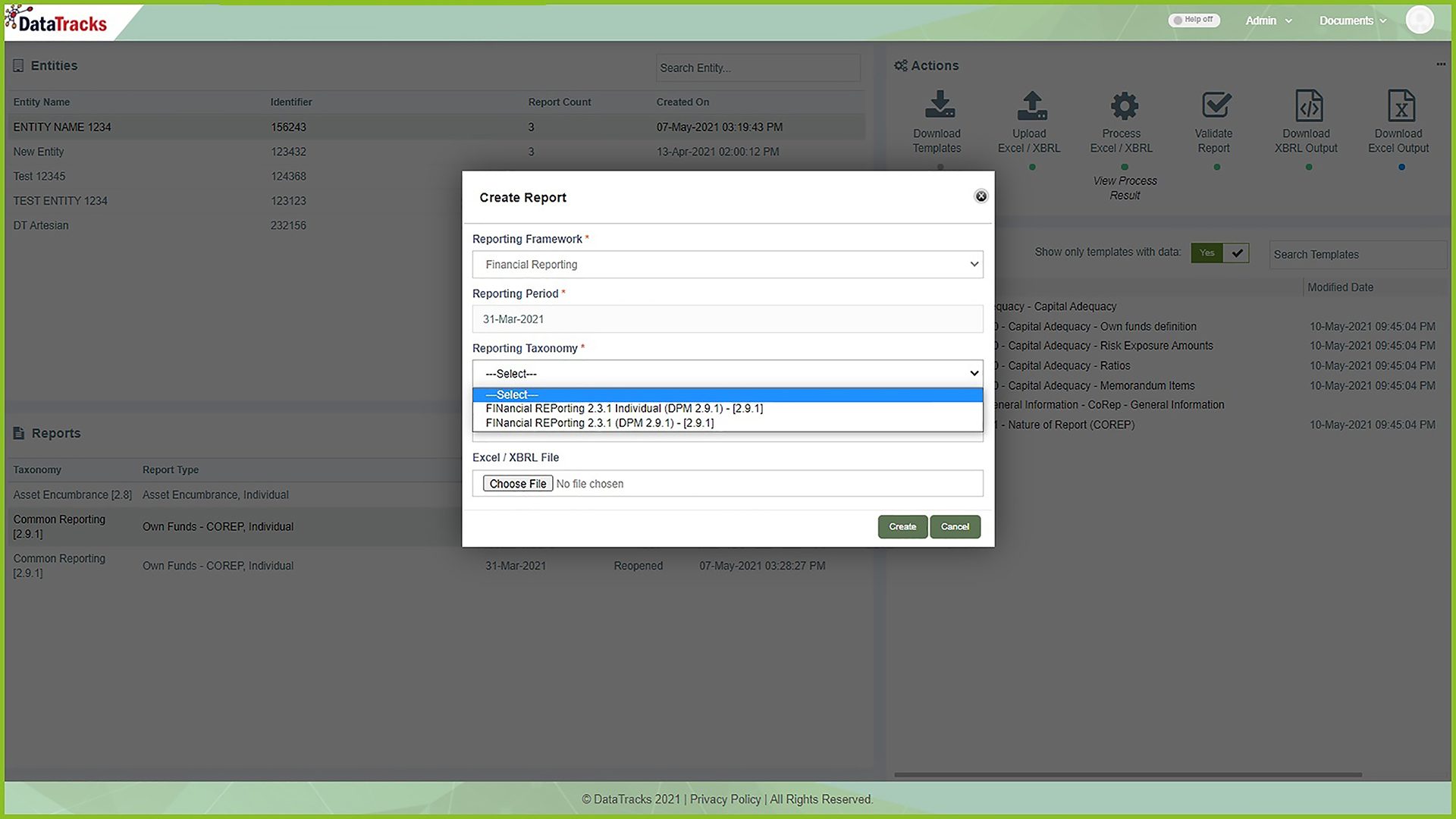

Flexible Data Entry

There are multiple ways to bring the content – upload of Excel template, online entry of data and automatic flow of data by linking with multiple data sources.

Quick and Easy Validation and Submission

DataTracks offers a simple and user-friendly platform that consolidates and navigates from the validation screen to the templates, allowing for quick and easy submission.

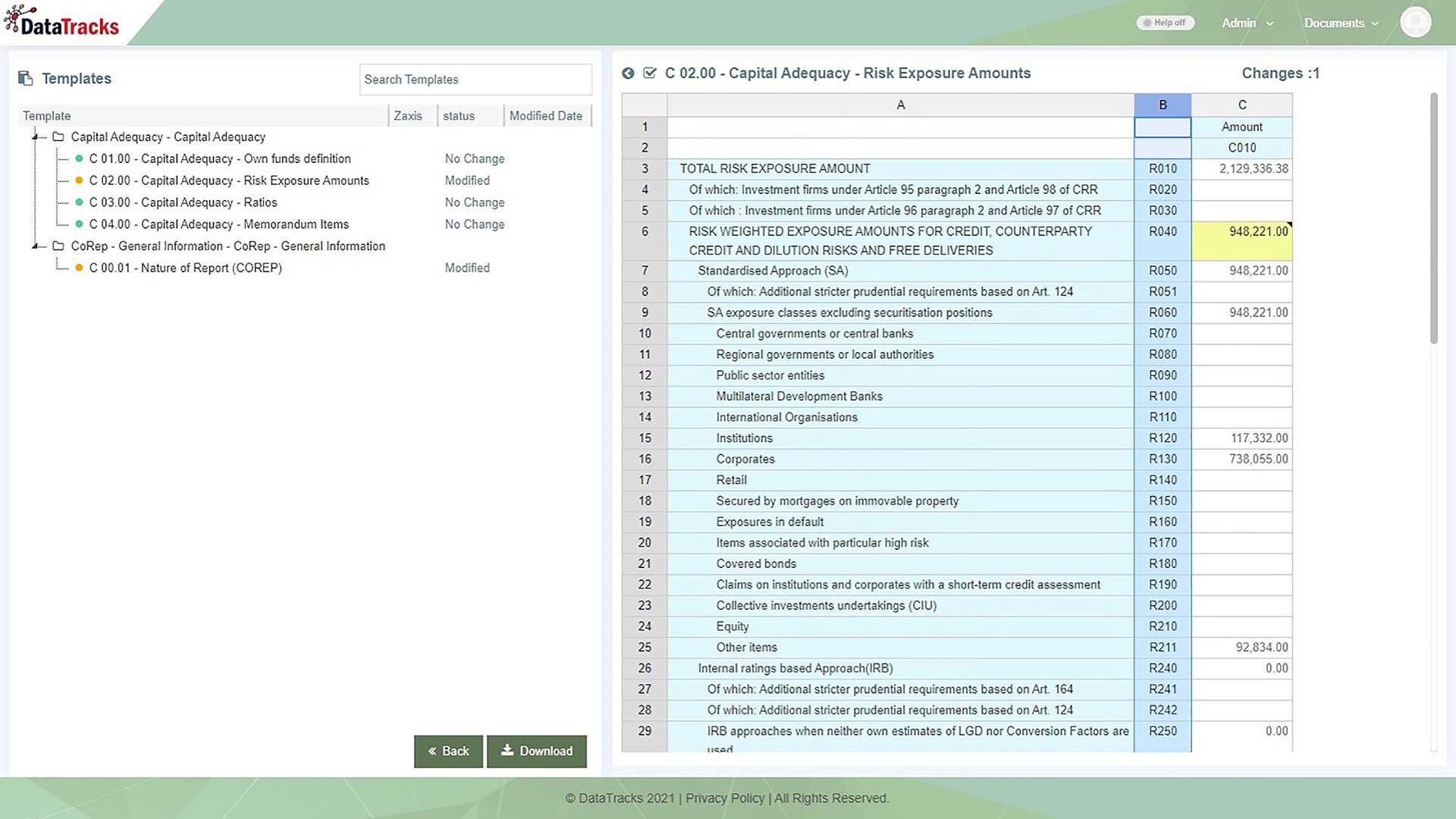

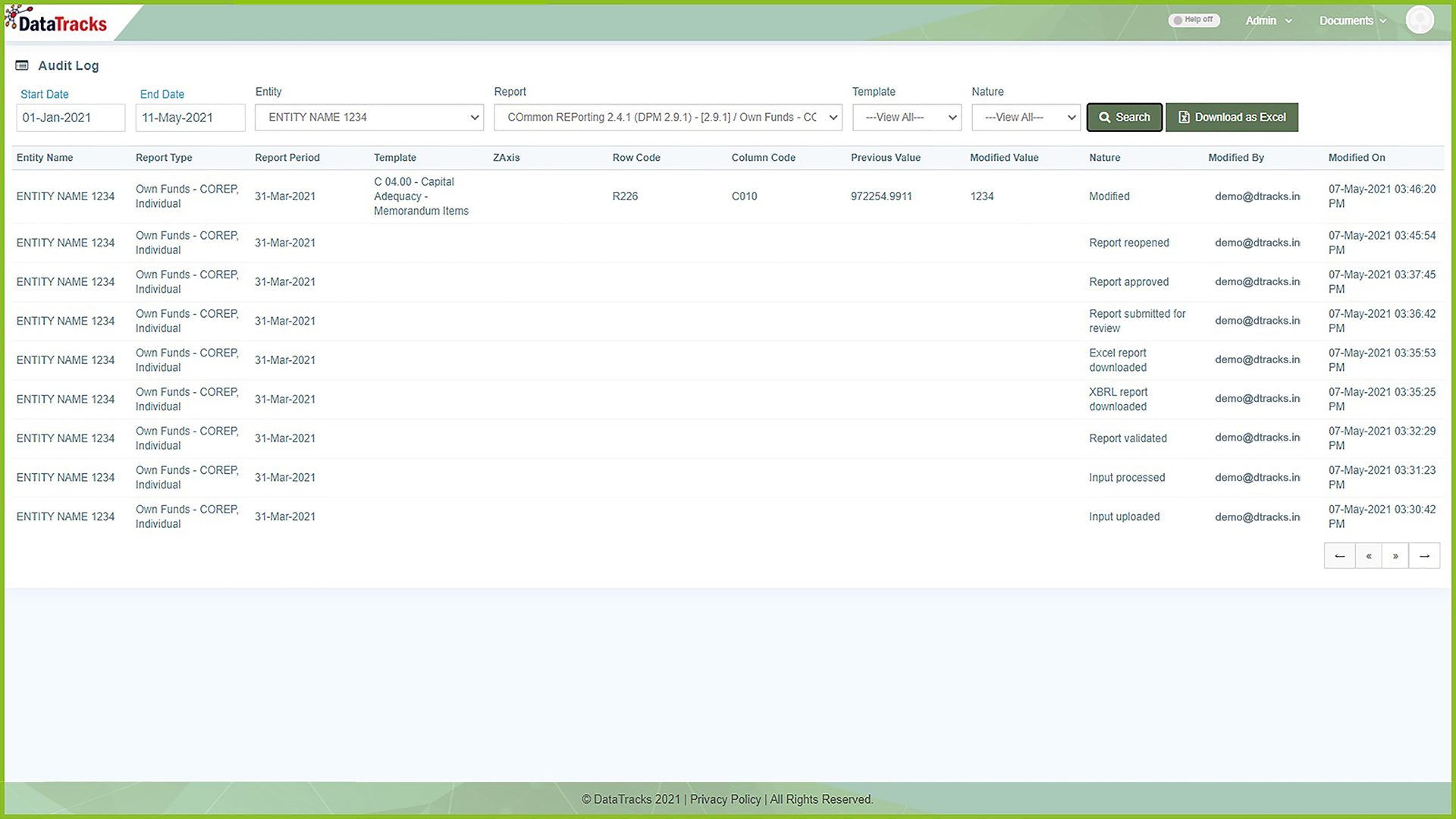

Comprehensive Audit Trail

Every change is tracked and reported as part of an audit trail, which ensures complete control over the report. The version comparison feature helps filers in terms of reviewing only the changes, rather than the full report.

Nimble and Friendly

Navigate through digital spreadsheets in a simple layout with pre-tagged CRD IV templates, for a seamless transition and adaptability. Light UI and user-friendly UX provide users with a smooth filing experience.

DataTracks covers all the facets related to CRD IV Reporting, from complex data entries to the corroboration of reports conforming to EBA reporting requirements and validation of errors.

Features That Differentiate Us