Overview of FATCA and Grandfathered Obligations

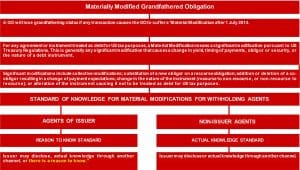

The United States (US) Foreign Account Tax Compliance Act (FATCA) stipulates that a 30% withholding tax must be made on any ‘withholdable payments’ made to any ‘Foreign Financial Institution’ (FFI) or ‘Non-Financial Foreign Entity’ (NFFE)[1] that does not comply with FATCA requirements. However, there are numerous exceptions available under FATCA. For instance, any payment made under a ‘Grandfathered Obligation’ (GO), or any gross proceeds from the disposition of such an obligation, is not considered to be a withholdable payment.[2] Withholding agents would be well advised to put in place a FATCA Grandfathered Obligations framework in order to identify GOs, and subsequently monitor for ‘Material modifications’, as Internal Revenue Service (IRS) penalties for incorrectly reporting amounts on withholding forms in under-withholding and over-withholding cases may be severe.

[1] FFIs include banks, custodial institutions, mutual funds, hedge funds, private equity funds, specified insurance companies, treasury centers.

[2] NFFEs include all foreign entities that are not classified as FFIs.

If you would like to discuss any of the implications of FATCA on your business, or for more information on our FATCA reporting solutions and prices, please email DataTracks at: enquiry@datatracks.co.uk.